Table of contents

- Can someone steal your identity with just your name and address?

- What else can scammers do with your name and address?

- 1. Steal your identity by combining data from breaches

- 2. Take over your accounts

- 3. Open new financial accounts in your name

- 4. Target you with phishing, fake invoices, or tax scams

- 5. Receive medical treatment using your name

- 6. Sell your data on Dark Web

- 7. Commit other types of fraud

- 8. Bypass security questions to access your accounts and services

- 9. Commit crimes and redirect blame using your identity

- 10. Perform SIM-swapping attacks to hijack your phone number

- 11. Use your identity to catfish others online

- How to protect yourself from identity scammers

- How to tell if someone has stolen your identity

- Conclusion

Can someone steal your identity with just your name and address?

Your name and address alone typically aren’t enough for identity theft. However, they’re crucial first building blocks criminals can use to launch more sophisticated attacks. That’s why taking steps to delete personal information from internet sources can significantly reduce the chances of scammers building a full profile about you.

Scammers use this basic information to create convincing phishing emails that look like they’re from your bank or employer. Because they know personal details about you, these messages seem authentic, making you more likely to click malicious links or share sensitive information.

When combined with even more information—like your social security number (SSN)—the damage can be tenfold. For more information, find out what someone can do with your social security number.

What else can scammers do with your name and address?

While your name and address alone won't open a credit line, they enable manipulation, targeting, and theft—especially when combined with other data. Here's what people can do with your name and address and how criminals escalate these basic details into serious fraud:

1. Steal your identity by combining data from breaches

Attackers don't rely on just one source. They collect your name and address from public records and then cross-reference this with data from breaches, social media profiles, and data broker sites.

When they combine information from multiple sources, they build completed identity profiles. At the end of the day, these might include your phone number, email, employment history, family members, and even financial details.

For peace of mind, learn how to protect personal information online.

2. Take over your accounts

Many password reset systems rely on address-based security questions like “What street did you grow up on?” or “What's your current ZIP code?”

Armed with your address history, scammers can answer these questions and gain permission to access your email, banking, and work accounts. It’s a good idea to learn how to avoid scam emails so that this never happens to you.

3. Open new financial accounts in your name

Your name and address alone won't guarantee loan approval, but scammers use this information with fabricated or stolen details to apply for credit cards, personal loans, or financing.

They may use your real address but a different phone number they control, allowing them to intercept approval notifications and convince financiers that they’re really you.

4. Target you with phishing, fake invoices, or tax scams

Criminals impersonate the IRS, local utility companies, or businesses you'd realistically interact with in your area.

Because they know your exact location, their scams seem legitimate. They might send fake tax notices, utility disconnection threats, or invoices for services supposedly provided at your address.

5. Receive medical treatment using your name

Medical identity theft is when someone uses your personal information to get healthcare services.

Scammers use your name and address to register at clinics or hospitals, leaving you with unexpected medical bills and incorrect information in your medical records that could affect future treatment and support.

6. Sell your data on Dark Web

Even “minor” personal information has value when sold in bulk to other criminals. Your name and address, combined with thousands of others, create databases that enable larger-scale fraud operations. This information is often packaged with other stolen data to create more valuable identity profiles.

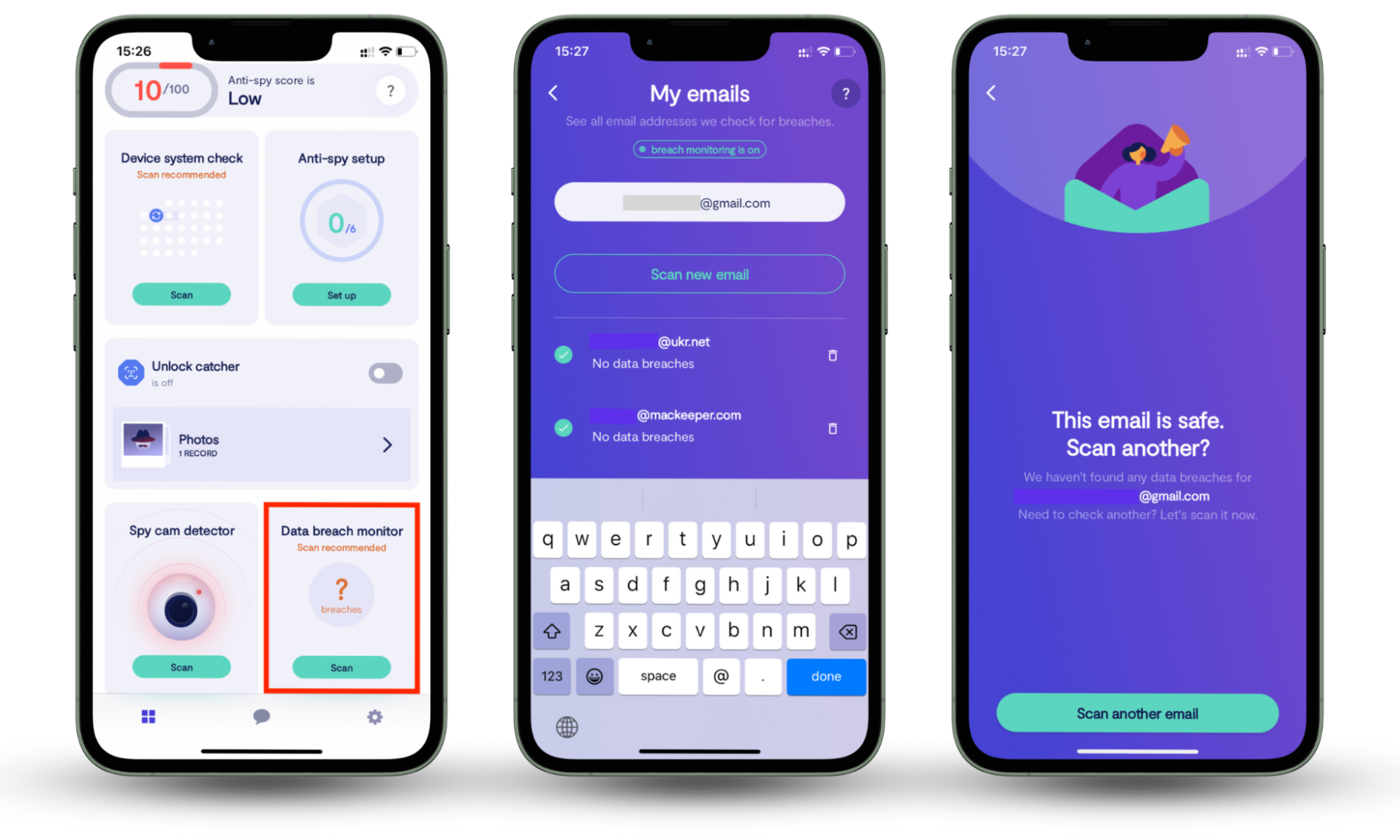

To see if your information is for sale on the Dark Web, use Clario Anti Spy’s Data breach monitor. This tool checks whether your email addresses and personal information has been targeted in data breaches so you can do something about it.

Here’s how to use Clario Anti Spy’s Data breach monitor:

- Open Clario Anti Spy and sign into your account.

- Locate the Data breach monitor tool, then press Scan.

- Enter your email address and wait for Clario Anti Spy to check the internet for signs of a breach.

7. Commit other types of fraud

Scammers use your identity for various types of fraud. With a name and address, it’s relatively easy to open online accounts, apply for services, or scam others.

One example is utility fraud (setting up electricity or internet service at different addresses using your name). They can also use it for unemployment benefits fraud, or creating fake lease agreements.

Similarly, they may also use your information to establish business licenses or register companies under your name.

8. Bypass security questions to access your accounts and services

Beyond password resets, it’s common customer service policy to use address verification as a security measure. Scammers who know your address can call your bank, insurance company, or other services and provide your address as “proof” of identity. Using this strategy, they potentially gain unauthorized access to sensitive account information.

9. Commit crimes and redirect blame using your identity

Criminals may use your name and address when arrested for minor offenses or traffic violations, especially if they don't have ID. This can result in warrants or legal issues appearing under your name and often takes significant time and effort to resolve.

10. Perform SIM-swapping attacks to hijack your phone number

Mobile carriers use name and address as verification during customer service calls. Scammers may contact your carrier, provide your personal information, and claim they need to transfer your phone number to a new SIM card. By doing this, they effectively hijack your phone number and any two-factor authentication (2FA) codes sent to it.

11. Use your identity to catfish others online

Fraudsters create fake dating profiles or social media accounts using your real name to make their personas seem authentic. They may even use your address to send “proof” photos or claim to live in your area, making their deception more engaging to potential victims.

How to protect yourself from identity scammers

With a few easy steps, you can make it much harder for scammers to exploit your personal information. Here’s what to do:

- Remove your data from people search sites: Search your name on sites like Whitepages, Spokeo, and BeenVerified. Use their opt-out forms to remove your listings. For faster removal, use a tool like DeleteMe.

- Enable 2FA: Turn on 2FA for your bank, email, and mobile provider accounts. Use authenticator apps like Google Authenticator instead of SMS where possible.

- Freeze your credit: If you notice signs that someone has stolen your information, go to Experian, Equifax, or TransUnion to place a credit freeze. This will prevent scammers from opening accounts in your name.

- Use a password manager: Create strong and unique passwords that are at least twelve characters long. Use tools like 1Password to store these passwords and avoid losing track of them.

- Turn on account alerts: Enable any login and suspicious activity notifications for your email and banking accounts. These will notify you if anything strange happens or if someone tries to access your information.

- Limit what you share online: Posting your full name, address, birth date, and other personal information increases the risk that someone will impersonate you. Avoid this at all costs—the less publicly available info about you, the safer you are.

- Monitor breach alerts. Use services like Clario Anti Spy’s Data breach monitor to periodically check if someone has leaked your information online. Knowledge is power—the quicker you find out, the faster you can take steps to secure your data.

In addition to these steps, using a reputable antivirus or anti-spyware software like Clario Anti Spy can protect your personal information online. Hackers use dangerous malware, spyware, and viruses to infect your devices and then collect your private information illegally. Cybersecurity software is a solid first line of protection.

How to tell if someone has stolen your identity

Identity theft often goes unnoticed until the damage is done, but there are warning signs to monitor. Keep an eye out for these important identity dangers to avoid falling victim:

- You receive mail from lenders and debt collectors about unknown accounts you never opened

- Your credit report shows inquiries or new accounts you don’t recognize

- Your bank or credit card statements have changed, or there’s someone else’s information connected to them

- Bills or account statements you usually receive suddenly stop arriving

- You’re denied credit or loans even though your credit score should be fine

- You get alerts for password changes, login attempts, or security questions that you didn’t trigger

- You have trouble logging into existing accounts

- Your credit score drops suddenly without a clear cause

- You receive government letters about benefits or tax filings that you never submitted

Each of these red flags is a sign that someone has gained access to your information (or is trying very hard to do so). If you see any of these, check your credit reports right away.

You’re entitled to free weekly reports from all three bureaus at AnnualCreditReport.com. Look for unfamiliar accounts, incorrect addresses, and suspicious activity.

Conclusion

Now you know what someone can do with your name and address, it’s time to act. Secure your online accounts, clean up any publicly available data, and start learning better privacy habits to protect yourself from these scammers.

Remember—Clario Anti Spy’s Data breach monitor helps you stay on top of leaked information. Scan the web for your email address and check whether you’re at risk today.