Table of contents

- Why does your Social Security Number matter?

- What can someone do with your Social Security Number?

- 1. Access your bank account

- 2. Open credit and bank accounts in your name

- 3. Open or update utilities on your behalf

- 4. Receive and steal benefits

- 5. Use your identity to avoid criminal liability

- How can your Social Security Number be stolen?

- 1. Phishing

- 2. Theft of physical documents with SSN

- 3. Man-in-the-middle attacks

- 4. Buying personal information from “inside” sources

- How to report someone using your Social Security Number

- Is there a way to protect your Social Security Number?

- 1. Know signs of phishing

- 2. Protect your online accounts with strong passwords

- 3. Don’t give out your SSN

- 4. Keep your Social Security card and documents safe

- 5. Enable MFA on your accounts when possible

- Conclusion

Why does your Social Security Number matter?

Your SSN confirms your identity with banks, employers, and government agencies. It allows you to work, pay taxes, and access Social Security benefits. You also need it to open bank accounts, apply for loans, and receive government services.

What can someone do with your Social Security Number?

If stolen, cybercriminals can use your SSN to open accounts, apply for loans, and commit fraud in your name, leading to financial loss and credit damage. They can also commit employment fraud, medical identity theft, tax fraud, and false claims on your benefits. Here’s what someone can do with your SSN:

1. Access your bank account

Criminals can use your SSN to pretend to be you and access your bank account. With your SSN, they can bypass identity checks and answer security questions that rely on your personal information. Once they gather enough information, they can reset your online banking password, letting them log in, transfer money, or make unauthorized purchases.

2. Open credit and bank accounts in your name

If a scammer has your SSN and personal information like your name, address, and birth date, they can open credit and bank accounts in your name. Armed with this information, they can fill out credit card or loan applications while posing to be you. Once approved, they can make purchases or withdraw money, leaving you with debt and damage to your credit score.

3. Open or update utilities on your behalf

With your SSN and personal details, fraudsters can impersonate you, contact utility providers like electricity, water, and internet companies, and provide your stolen information to apply for new accounts.

Once set up, they’ll receive the utility services while leaving you responsible for the bills. And since utility companies don't require rigorous checks beyond basic information, it's easy for thieves to manipulate the system.

4. Receive and steal benefits

Scammers can impersonate you with fraudulent paperwork, filing claims for benefits under your name. If successful, they’ll be able to redirect funds to their own accounts, leaving you without the benefits you’re entitled to receive. Worse, this type of fraud can go unnoticed until you attempt to claim benefits, leading to financial hardship while you try to resolve the issue.

5. Use your identity to avoid criminal liability

If a criminal assumes your identity while committing a crime, they might be able to shift the responsibility and criminal records to you. This can lead to wrongful accusations and legal trouble if they successfully evade the consequences. Finding out and trying to fix these issues can be complex, potentially damaging your reputation.

How can your Social Security Number be stolen?

Unfortunately, there are several ways that criminals can steal your SSN, including phishing, theft, cybercrime, hacking, and purchasing your information from illegal online marketplaces. Let’s take a closer look at these methods.

1. Phishing

Phishing is a social engineering tactic where scammers deceive you into giving them your personal information. They’ll send emails or texts that look like they’re from real banks or companies. They’ll try to get you to hand over your details or follow a link to a fake website that asks you to enter your SSN. Once submitted, the criminals can use your information for fraud.

2. Theft of physical documents with SSN

Scammers can steal your SSN if physical documents containing it fall into the wrong hands. This can happen if someone accesses your mail—like tax forms, bank statements, or insurance documents, which often include your SSN.

Likewise, someone might get your SSN by stealing your wallet or purse. Even dumpster divers might target documents you’ve thrown in the bin.

3. Man-in-the-middle attacks

If attackers breach your network security, they can intercept data transmitted over supposedly secure connections. They can place themselves between your device and a target website using unsafe networks, like public Wi-Fi. If the connection is unencrypted, they’ll be able to read and capture sensitive information—including your SSN, if you’re unlucky.

4. Buying personal information from “inside” sources

When a data breach happens, cybercriminals access a company's database and steal personal information. After getting this information, they sell it on the dark web, where other criminals can buy it.

This type of online scam can expose your personal details to a broad network of criminals, increasing the risk of identity theft. To see if your personal information has been leaked in part of a data breach, use Clario Anti Spy.

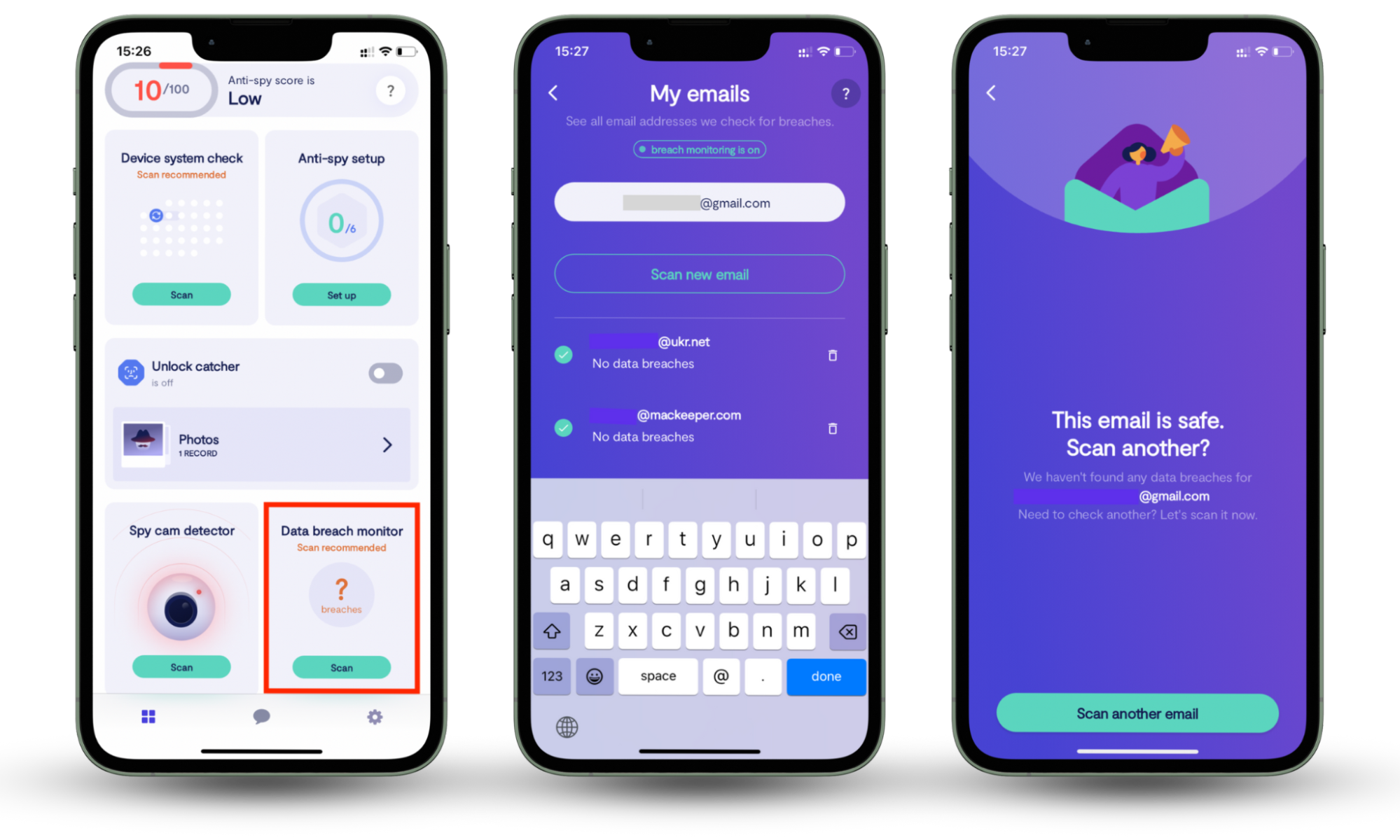

Here’s how to use Clario Anti Spy’s Data breach monitor to scan your email accounts:

- Download Clario Anti Spy and create an account.

- Open the app, then press Scan beneath Data breach monitor.

- Enter your email address in the field provided, then press Scan new email. Wait for Clario Anti Spy to display the results. If it says, “No data breaches,” then you’re safe! Press Scan another email to check all of your accounts.

How to report someone using your Social Security Number

If someone is using your SSN fraudulently, it’s important to act quickly to minimize the damage they can do. Here’s who you should report the crime to:

- Contact the Federal Trade Commission (FTC). Visit identitytheft.gov to report the identity theft. The FTC will provide a recovery plan and documentation to help resolve the issues.

- Call the Social Security Administration (SSA). Call the SSA’s fraud hotline at 1-800-269-0271 to report the misuse.

- Place a fraud alert. Contact one of the three major credit bureaus—Equifax, Experian, or TransUnion—to place a fraud alert on your credit report. This makes it harder for an identity thief to open new accounts in your name.

- File a police report. Contact your local law enforcement to file a report. While they may not be able to investigate identity theft directly, having this report can help clean up your credit records.

Is there a way to protect your Social Security Number?

Yes, to protect your SSN, you should know the signs of phishing to avoid scams. Use strong passwords for online accounts and enable multi-factor authentication (MFA) where possible. Finally, avoid giving out your SSN and keep your Social Security card and related documents in a secure place. Let’s explore these in more detail.

1. Know signs of phishing

Spot phishing by looking for suspicious emails or messages with urgent requests, unfamiliar sender addresses, poor grammar, and links resembling real websites. To protect your SSN, always verify the sender's identity and head directly to official websites instead of clicking links.

2. Protect your online accounts with strong passwords

Prevent hackers from accessing your accounts by using strong, unique passwords. Combine uppercase and lowercase letters, numbers, and symbols into passphrases at least 12 characters long. Avoid easily guessable information and regularly update your passwords to reduce the risk of data theft.

3. Don’t give out your SSN

Only share your SSN when absolutely necessary and verify every request. Avoid disclosing it over the phone, email, or online, especially when the messages are unsolicited. Use alternatives like a driver’s license number, when possible, to reduce the risk of identity theft. If you’re worried someone already has your SSN, here’s how to protect your identity from theft.

4. Keep your Social Security card and documents safe

Store your Social Security card and documents in a secure place, like a safe or lockbox, and avoid carrying them in your wallet. Only access them when necessary. This limits the risk of theft or loss, protecting your SSN from unauthorized access.

5. Enable MFA on your accounts when possible

Enable multi-factor authentication (MFA) on accounts to strengthen security. This adds an extra verification step beyond your password, sending a code to your phone to prove it’s you. It’s a powerful way to keep your SSN safe by reducing the risk of scammers accessing your accounts.

Conclusion

Your SSN is a gateway to your financial and personal identity, making it a prime target for fraudsters. Protect yourself by recognizing threats and taking proactive measures. Stay informed and secure your identity with Clario Anti Spy's Data breach monitor, which can alert you to potential breaches and prevent hackers from accessing your accounts.