Table of contents

- How does identity theft work

- Examples of identity theft

- What are the dangers of identity theft

- How often does identity theft happen

- Who are the major targets of identity theft

- How can identity theft happen

- 1. Data breaches

- 2. Phishing scams

- 3. Lost or stolen documents

- 4. Social media and public information

- 5. Malware attacks

- 6. Card skimming

- What to do in case of identity theft

- How do you report identity theft

- Ways you can protect yourself from identity theft

- Conclusion

How does identity theft work

Identity theft is a cybercrime that can leave you feeling isolated and stranded. This is why it is absolutely crucial you learn how it happens and what the consequences can be.

Perpetrators conduct identity theft in two steps: they employ various techniques to illegally steal personal information and then utilize it for fraud. Let's take a look at the ways they steal people's data:

- Phishing attacks. Hackers send fraudulent emails or messages from seemingly trustworthy sources, requesting recipients reveal confidential details.

- Smishing and vishing: There are fraudulent text messages (smishing) and voice calls (vishing) intended to trick victims into giving up their personal details.

- Dumpster diving: Yes, you read it right. Thieves will go as far as rummaging through your trash to get discarded documents containing your precious personal details.

- Skimming: Devices like card skimmers, overlay keypads, hidden cameras, etc., are secretly fitted onto ATMs or point-of-sale terminals to capture card information during legitimate transactions.

- Malware and infostealers: Malicious software can infect systems to extract sensitive information, such as login credentials and financial data.

- Data breaches: Illegal hacking into institutional or corporate databases can expose huge volumes of personal data.

Data breach databases are the easiest way for cybercriminals to access your personal data. Your name, address, password, social security number, etc., can sit there for months before a malicious actor decides to use it for their own ends. Luckily, you can check if your personal information has been part of a data breach before cybercriminals find it.

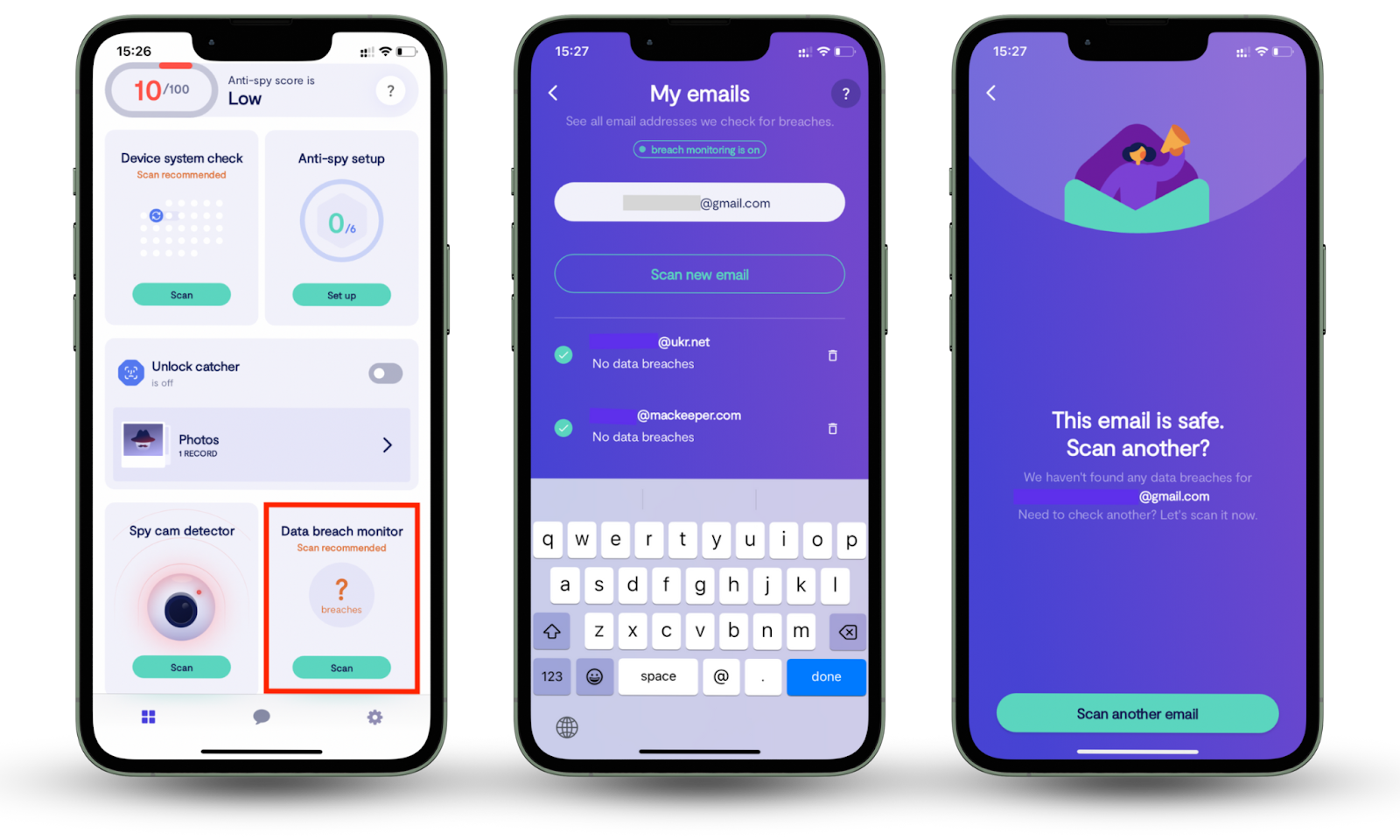

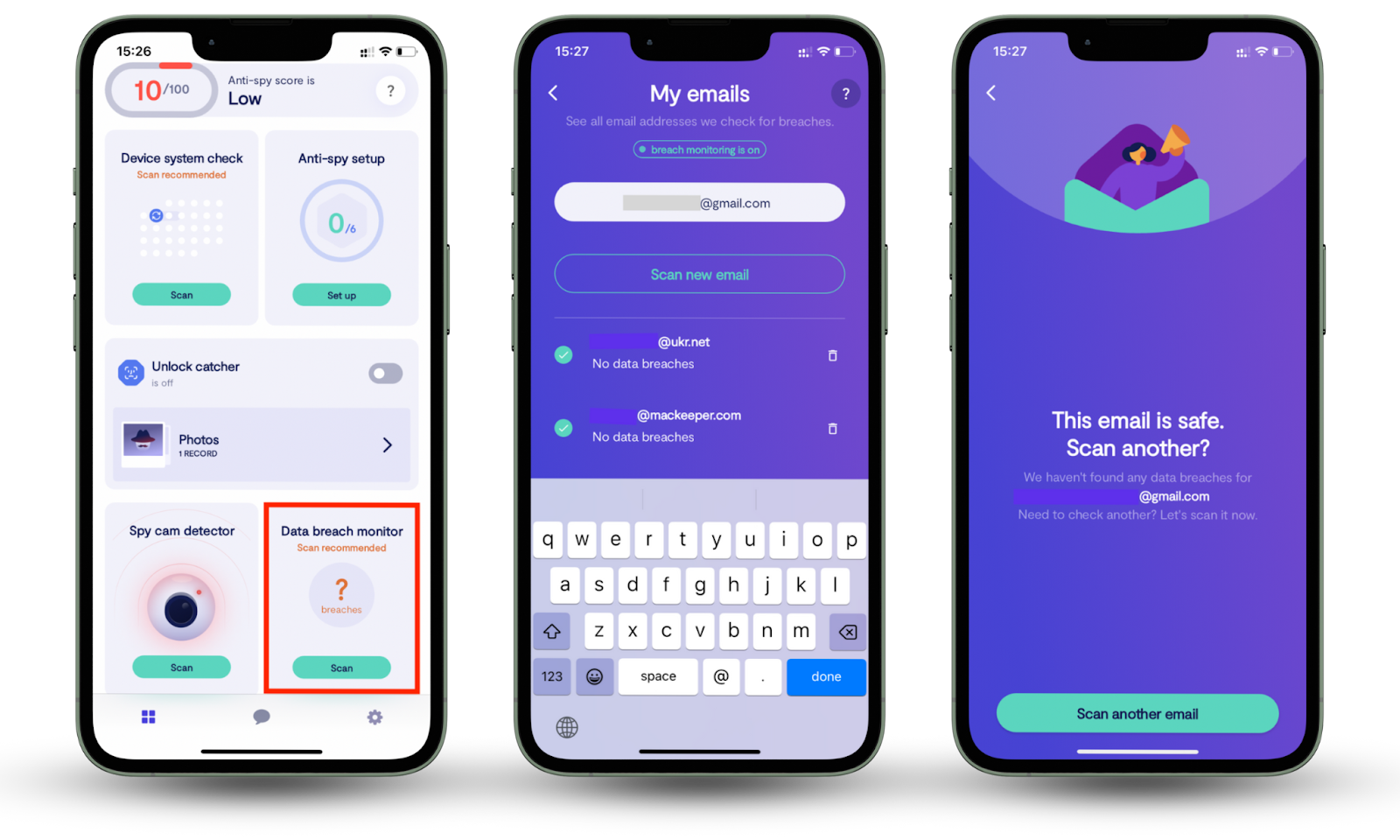

Use Clario Anti Spy's Data breach monitor to see if your data has been compromised:

- Download Clario Anti Spy and create an account.

- Click Scan under Data breach monitor.

- Enter your email, then click Scan.

- Wait for the scan to end and follow the on-screen instructions.

You can rest assured that no one will be using your email to hack into your accounts once you remove all threats. Read on to discover what else can happen if you become a victim.

Examples of identity theft

Understanding these techniques enables you to safeguard yourself more effectively against identity theft and its extensive impact on your life:

- Financial fraud: Using stolen data to buy goods without authorization, open new credit accounts, or withdraw money from the victim's bank accounts.

- Tax refund fraud: Filing false tax returns to obtain refunds in the victim's name.

- Medical identity theft: Obtaining medical care or prescription drugs using someone else's identity.

- Employment fraud: Using stolen personal information to gain employment.

- Criminal impersonation: Giving someone else's information upon arrest can result in erroneous criminal records for the victim.

What are the dangers of identity theft

Identity theft can lead to empty bank accounts, ruined credit scores, denied loans, and legal issues. Identity theft is a cybercrime that can cause victims months of emotional trauma, time-consuming attempts to rebuild lives, and financial upheaval.

Criminals will steal your personal data—like your Social Security number, account data, or ID—to impersonate you. With this information, they can request credit cards and loans, file fraudulent tax returns, or even commit crimes. Most victims are unaware until after significant damage has been done. The best way to avoid falling victim to identity theft is to remove your personal data from open sources altogether.

How often does identity theft happen

Identity theft happens more often than you might think—every 22 seconds, according to recent estimates. In the US alone, nearly 24 million people were victims of different types of identity theft in 2021, according to the Bureau of Justice Statistics, and it is now one of the most common and fastest-growing crimes.

Behind the numbers, the impact is terrifying. The AARP Fraud Report shows that identity theft drained Americans of $43 billion in 2023, and it took victims months, in some cases even years to recover. Credit card scams, loan scams, and hijacked government benefits are among the most common types reported.

Tip from our experts:

With more personal data online than ever, Clario Anti Spy experts advise implementing cybersecurity practices proactively to avoid falling victim to identity theft. Use strong passwords, enable two-factor authentication (2FA), monitor your credit reports, use a VPN, and share less personal information on social media.

Who are the major targets of identity theft

Identity thieves typically target seniors, young adults, and high-income professionals due to their perceived vulnerabilities and their information’s value.

Seniors are constantly targeted because they are thought to be less knowledgeable about digital security habits, possess substantial savings, and are generally more trusting. Scammers exploit these traits through phishing emails, tech support scams, and bogus charities.

Young adults aged 18 to 29 are also at risk. Their extensive usage of social media and websites means they can be prone to oversharing personal information, which identity theft criminals can then use to scam their victims.

High-paying professionals attract identity thieves because they have considerable amounts of money and good credit scores. Criminals can target them with sophisticated schemes, such as business email scams or investment scams.

If you are in one of these most at-risk groups, consider implementing effective measures to protect yourself from online identity theft. As a parent of a young adult or a child of senior parents, educate your close ones on cybersecurity practices to help them navigate the web safely.

How can identity theft happen

Identity theft is achievable through data breaches, phishing attacks, lost documents, public disclosure of information, malware, card skimming, and many more sneaky schemes. Each method offers criminals access to sensitive personal information. Typically, the victim doesn't even know about the privacy breach until after significant damage has been inflicted.

1. Data breaches

Data breaches occur when hackers obtain unauthorized access to databases containing sensitive personal information. The majority of breaches are caused by exploited or weak passwords that allow network access.

For example, in December 2024, over 240,000 SRP Federal Credit Union members had their Social Security numbers, addresses, and financial information stolen in a record-breaking data breach. Such incidents often lead to more fraud, including loan scams and credit card fraud.

Luckily, you can now check if your personal data has been part of a data breach. If your email, SSN, or even your full name and phone number have been stolen, change your passwords immediately to avoid falling victim to identity theft.

To check if your data has been a part of a data breach, use Clario Anti Spy’s Data breach monitor:

- Download Clario Anti Spy and create an account.

- Click Scan under Data breach monitor.

- Enter your email, then click Scan.

- Wait for the scan to end and follow the on-screen instructions.

Read more: What can someone do with your SSN?

2. Phishing scams

Phishing scams occur when cybercriminals trick people into releasing their personal data through fake emails, texts, or calls. The schemes generally impersonate reliable sources—banks or government offices—and use aggressive language to prompt quick action.

An unfortunate but very recent example of a phishing scam happened in March 2025, when the FBI issued a national alert about a surge in "smishing" attacks against iPhone and Android users. Cybercriminals registered more than 10,000 domains to send impersonating text messages as official entities like toll collection agencies and delivery services.

The messages informed the recipients that they had unpaid tolls or missed deliveries and encouraged them to click on malicious links. Clicking these links directed victims to fake sites designed to steal their financial and personal data, including bank account and credit card information. The FBI encouraged recipients to immediately delete such messages and avoid replying to unsolicited texts requesting sensitive information.

3. Lost or stolen documents

Physical documents—such as passports, driver's licenses, or bank statements—are often used to commit identity theft when lost or stolen. Burglars can then use them to open accounts or procure loans in your name.

Pay attention

If your credit card or driver's license gets stolen, report it immediately. Contact your state's DMV to obtain a replacement of the license and inform the police to document the theft. With stolen credit cards, contact your bank or credit card company to freeze the account and prevent an unauthorized individual from using it. You can also place a fraud alert on your credit bureaus and report at IdentityTheft.gov for an individualized recovery plan.

4. Social media and public information

Sharing too much online can make you a target—your birthday, location or home address, or names of family members can be used to try to guess passwords, fill out security questions, or craft personalized scams.

Also, beware of data brokers—these websites specialize in gathering information on people and creating their profiles so that they can later sell them to the highest bidder. Then, your information gets exploited, and you end up at a financial loss or, worse, in legal consequences. Delete sensitive information from your social media and go through the biggest data brokers to completely delete your info from online sources.

5. Malware attacks

Malware is malicious software that infiltrates your device and purloins personal data—such as login credentials, bank account numbers, or an entire digital identity. It often runs under the radar, capturing your keystrokes (keyloggers), screen, or monitors sensitive data transmitted online.

Most users unwittingly install malware by clicking suspicious links, downloading phony software updates, or opening infected email attachments. When malware gets in, it can lead to widespread identity theft.

For example, in July 2024, the Florida Department of Health fell victim to a ransomware attack by RansomHub. They hacked into the system and stole over 40,000 sensitive patient records, including lab results, full names, Social Security numbers, and other personal information. The data was posted on the dark web after the department declined to pay the ransom, exposing thousands to potential identity theft and financial fraud.

Tip

If you are from Florida or live there, check if your records are still out there with Clario Anti Spy’s Data breach monitor.

Follow these simple rules to avoid falling victim to malware attacks:

- Do not download software from unknown sites.

- Update antivirus and operating system software.

- Never click on suspicious links or check files.

6. Card skimming

Card skimming is when criminals attach small hidden devices to ATMs, pumps, or payment terminals to capture card data when you make a legitimate purchase. These skimmers scan the magnetic stripe on your card and are sometimes affixed with micro cameras or fake keypads that capture your PIN.

Once criminals have your information, they can then create fake cards or use your data to shop online, withdraw cash, or sell it on the dark web. In many cases, customers are unaware that they've been targeted until unauthorized transactions appear.

Always check out the card reader before inserting your card—if it looks loose, bulky, or off, don’t use it. Pick ATMs inside bank branches and, whenever possible, stick to tap-to-pay or mobile wallets like Apple Pay.

What to do in case of identity theft

To file a report on identity theft, go to IdentityTheft.gov to develop a recovery plan, report it to the police, and notify credit bureaus to put fraud alerts or freeze your credit.

How do you report identity theft

Here’s a step-by-step action plan to report identity theft:

- Report to the FTC

- File a police report

- Notify credit bureaus

- Monitor your credit

Report to the FTC

So, begin at IdentityTheft.gov or by phoning 1-877-438-4338. The FTC will help you draft an Identity Theft Report and customize a recovery plan. This report is an official record that can assist you in challenging fraudulent accounts.

File a police report

Report it to your local police department. Take your FTC Identity Theft Report, a government-issued identification, proof of address, and any proof of the theft with you. Creditors may request a police report to help remove fraudulent charges.

Notify credit bureaus

Put a fraud alert or credit freeze on your credit reports by contacting one of the three major credit bureaus:

- Equifax: 1-800-525-6285 | equifax.com

- Experian: 1–888–397–3742 | experian.com

- TransUnion: 1-800-680-7289 | transunion.com

The bureau you call will contact the others. A fraud alert is free and lasts one year. A credit freeze will prevent new accounts from being opened in your name and will stay in place until you remove it.

Tell banks, credit card issuers, and companies where fraudulent accounts were opened. Lock or freeze affected accounts and contest unauthorized charges. Ask for new account numbers and cards.

Monitor your credit

Monitor your credit reports regularly for new activity. Research free yearly reports through AnnualCreditReport.com. Also, you might want to sign up for credit monitoring services that will alert you whenever something changes or appears on your credit file.

Learn more on what to do if your identity has been stolen in the Clario Anti Spy blog.

Ways you can protect yourself from identity theft

Ensure your password is strong, enable 2FA, check for your credit reports, keep personal things secure, and be cautious when sharing personal info over the internet or on call.

Here’s what you can do to prevent identity theft:

- Use strong, unique passwords.

- Enable 2FA.

- Monitor your credit reports for unauthorized activity.

- Keep sensitive documents, like Social Security cards and passports, in a secure location.

- Use a VPN.

- Stay informed about popular scams and identity thieves’ methods—the FTC maintains the Consumer Advice website with detailed information on active scams and how to avoid them.

Conclusion

Identity theft isn’t just a financial hassle—it’s a very personal assault that can upend your credit, mental health, and even your legal status. With nearly 24 million cases reported each year in the US alone and billions lost to fraud, it’s safe to say this threat isn’t going away anytime soon.

If you suspect you’ve fallen victim to identity theft, don’t delay. Instantly report it to IdentityTheft.gov, contact your bank and credit bureaus, and file a police report to start regaining control of your personal data.

To see which accounts are in danger, use Clario Anti Spy’s Data breach monitor, which will scan the most recent breach databases and the dark web for your personal data. Once you know which accounts have been compromised, follow Clario Anti Spy’s instructions on restoring your privacy.