Table of contents

- What is identity theft

- How identity theft happens

- Warning signs of identity theft

- Unfamiliar charges or withdrawals

- New accounts in your name

- Declined transactions or locked accounts

- Missing or redirected mail

- Drops in credit score

- Unexpected authentication codes

- How to check if someone is using your identity

- 1. Review your credit reports

- 2. Monitor bank and credit card activity

- 3. Track your mail and bills

- 4. Use identity monitoring tools

- 5. Pay attention to credit bureau alerts

- What to do if you suspect identity theft

- Action plan for identity theft victims

- Conclusion

What is identity theft

Identity theft is when someone steals personal data, such as your name, Social Security number (SSN), or credit card details, then misuses this information for fraud. Criminals may open accounts, apply for credit lines, or even steal insurance benefits in your name, especially health insurance.

How identity theft happens

Cybercriminals use a wide variety of tactics to steal personal data:

- Phishing emails trick victims into revealing account logins or card numbers on malicious websites. Learning how to identify fake text messages, including phishing ones, is very useful in keeping your personal data secure.

- Data breaches in databases often expose millions of emails, passwords, phone numbers, etc. This information is usually later sold on the dark web.

- Some thieves resort to “dumpster diving” for discarded mail.

- Placing skimming devices on ATMs is a popular way of stealing card numbers.

- More advanced schemes include SIM swapping, where attackers hijack your phone number to intercept two-factor authentication codes.

- Social engineering is also one of the most effective ways to tease out valuable data by manipulating you into believing you’re talking to a bank representative or a representative from another reputable establishment.

Because attackers constantly adapt, it’s important for online users to stay informed about the different types of identity theft and learn how to check for identity theft using both proactive monitoring and trusted security services.

Warning signs of identity theft

Warning signs of identity theft include unexpected credit card charges, new accounts you didn’t open, declined transactions, missing mail, or sudden drops in your credit score.

By learning more about each sign of identity theft, you should be able to detect it early by monitoring your financial statements, reviewing your credit reports, and setting up fraud alerts.

Unfamiliar charges or withdrawals

Have you spotted any transactions you didn’t authorize on your credit card or bank account? This usually means someone has access to your online banking and is now testing it before going big on spending. Immediately contact your bank and request a freeze on your card. Even small-dollar charges can signal fraud testing.

What’s fraud testing?

Fraud testing occurs when criminals make small, low-value transactions with a stolen card or account to see if it is still active. If the charge goes unnoticed, they often move on to larger, more damaging purchases.

New accounts in your name

If you’ve received mail about unfamiliar accounts or loan applications, be aware that this is a strong sign of identity theft. Criminals often apply for credit cards or loans using stolen data. Regularly check for identity theft by reviewing your credit reports and disputing accounts you never opened.

Declined transactions or locked accounts

If your legitimate purchases get declined or your account is suddenly locked, it could mean someone else is maxing out credit in your name. Immediately contact your bank to investigate and freeze any compromised accounts.

Missing or redirected mail

Not receiving bills, bank statements, or government letters may indicate that thieves have changed your mailing address to hide any fraudulent activity. If you are not receiving any correspondence, call the company that normally sends your bills to confirm whether your mailing address was altered, and immediately update your contact details. Then, check your credit report for any new accounts linked to this stolen information.

Drops in credit score

A sudden decline in your credit score without a reason can point to new, unauthorized charges, new accounts, and unpaid debts linked to your identity. Using identity theft monitoring services can help detect these changes quickly and alert you to potential fraud.

Unexpected authentication codes

Receiving two-factor authentication (2FA) codes you didn’t request is a very strong indicator that someone is trying to access your accounts. Treat this as a serious warning and update your passwords immediately if you still have access to your accounts.

How to check if someone is using your identity

Check for identity theft by reviewing credit reports, monitoring bank and card activity, setting fraud alerts, and using identity monitoring tools that scan data breach databases on the dark web for your compromised personal information.

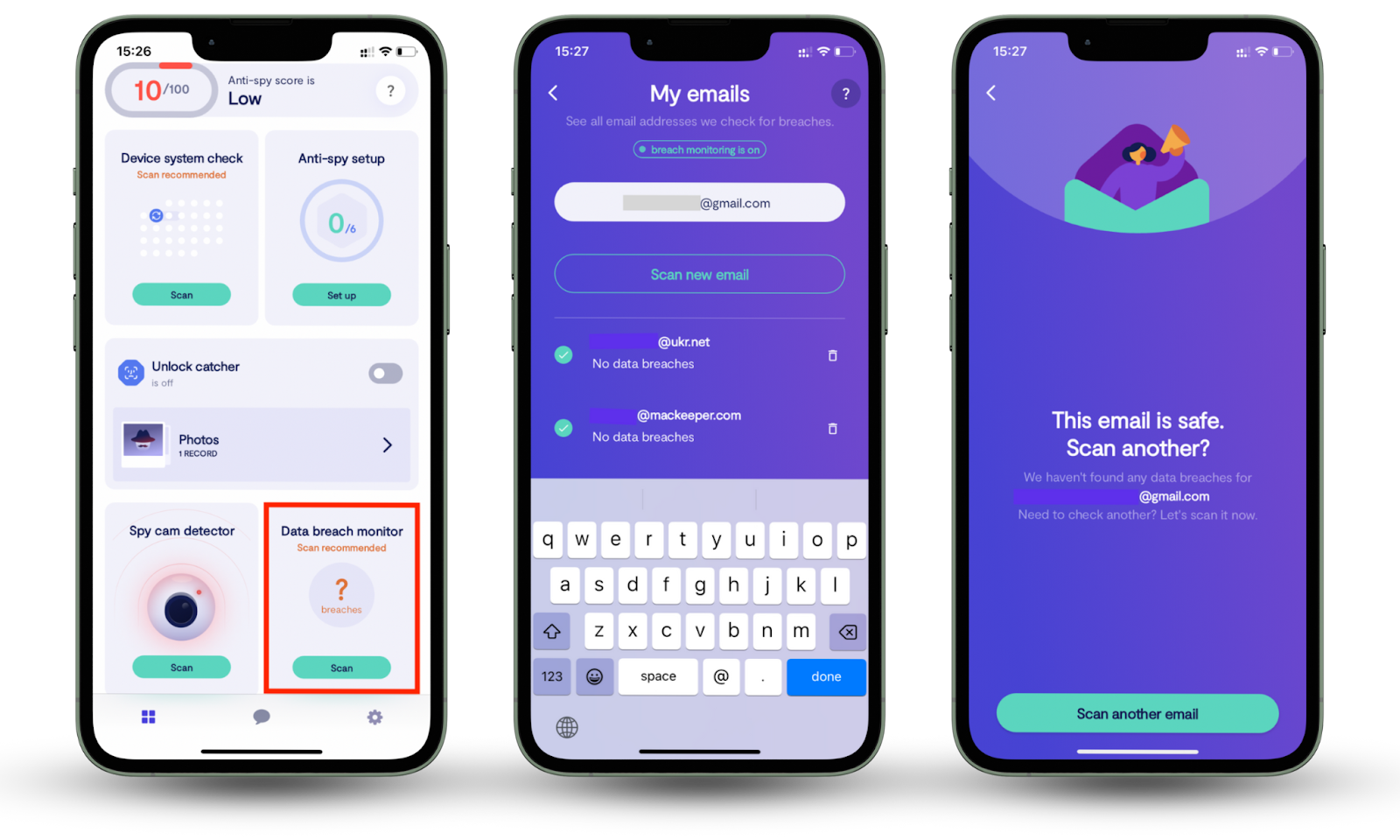

One such tool is Clario Anti Spy’s Data breach monitor. This helps you check if your data has been hacked and notifies you if you need to take immediate action.

Here’s how to use Clario Anti Spy’s Data breach monitor:

- Download Clario Anti Spy and create an account.

- Click Scan under Data breach monitor, then add your email address.

- Wait for Clario Anti Spy to run a scan.

- If it detects a data leak, follow the instructions to immediately eliminate any risks.

1. Review your credit reports

Start by requesting your credit reports from Experian, Equifax, and TransUnion. Look for accounts you don’t recognize, loans you never applied for, or a sudden increase in inquiries. These are classic warning signs that someone may have stolen your identity and used your name to apply for financial products.

2. Monitor bank and credit card activity

Fraud often begins with small “test” charges before thieves attempt larger purchases. Regularly check your statements for strange activity and set up transaction alerts through your bank’s mobile app. If you see charges you didn’t make, dispute them immediately and report fraud.

3. Track your mail and bills

Missing bills or receiving unfamiliar financial statements can indicate fraudsters have changed your address or opened accounts in your name. Always follow up on unexplained gaps in your billing cycle.

What if your email has been hacked? There are ways to ‘un-hack’ it—read more on dealing with this issue on the Clario Anti Spy blog.

4. Use identity monitoring tools

Checking every account manually is time-consuming. Instead, Identity theft detection services can help you with this. They scan the dark web, data breach databases, and suspicious activity tied to your SSN, phone number, or email. Identity theft monitoring services provide real-time alerts that make it easier to act fast if your data is compromised.

5. Pay attention to credit bureau alerts

If your data is stolen and used in an application, a fraud alert from credit bureaus can serve as an early warning. Always follow up and confirm whether this activity is legitimate or identity theft in progress.

What to do if you suspect identity theft

If you suspect identity theft, place a fraud alert, freeze your card, and notify creditors about unauthorized activity. Then, file an FTC Identity Theft Report, contact the police, and document everything to help restore your accounts and prevent further misuse.

Action plan for identity theft victims

- Step 1. Place a fraud alert immediately. Contact one of the three credit bureaus (Equifax, Experian, or TransUnion). You only need to call one; they are legally obliged to inform the other two by law. Ask to place a 90-day fraud alert on your file. Lenders will then be required to verify your identity before approving new credit. This will prevent criminals from committing further fraud.

- Step 2. Freeze your credit for stronger protection. Go to each credit bureau’s website (Equifax, Experian, or TransUnion) and request a credit freeze. It’s free, and you’ll get a PIN or password to temporarily use in case you want to apply for credit yourself. This step blocks new accounts from being opened in your name.

- Step 3. Contact your bank. Call your bank's fraud department, credit card issuer, or lender. Explain that you’re a victim of identity theft and ask them to close compromised accounts, issue new cards/account numbers, and reverse fraudulent charges. Always get confirmation that they will do this in writing.

- Step 4. File a report with the FTC. Go to identitytheft.gov and fill out the Identity Theft Report form. This creates an official recovery plan you can use to dispute fraudulent debts. Print or save copies—you’ll need them for creditors and potentially your bank.

- Step 5. Report to local law enforcement. Bring your FTC report, government ID, proof of address, and any evidence (statements, alerts, letters) to your local police station. File a police report and request a copy. This gives extra credibility when disputing fraudulent accounts.

- Step 6. Keep a recovery log. Screenshot every bit of evidence: dates of calls, names of representatives, case numbers, and notifications of fraudulent actions. Having this organized record speeds up disputes and helps if you need legal support later.

Conclusion

Identity theft can feel invisible until it suddenly hits you, impacting your finances, reputation, or credit score. But the sooner you detect identity theft, the less damage fraudsters can do. Regularly checking your accounts, monitoring credit reports, and acting quickly on suspicious alerts are your best defenses against the misuse of stolen data.

Manual checks are helpful, but they can’t catch everything. A more innovative approach is using automated monitoring tools that continuously scan for your compromised information across the dark web and data leaks. That’s exactly what Clario Anti Spy’s Data breach monitor does—instantly alerting you if your email, passwords, or other personal data are found, so you can lock down your accounts before criminals exploit them. Stay safe out there!