Table of contents

- What is identity theft?

- What identity theft protection services do

- Is identity theft protection worth it?

- How to know if you need ID theft protection

- Best identity theft protection

- 1. LifeLock

- 2. Aura

- 3. ID Watchdog Premium

- 4. IDShield

- 5. IdentityForce

- 6. Identity Guard

- 7. IdentityIQ

- 8. IDX Complete

- 3. Clario Anti Spy

- Compare and choose the right identity theft protection service for your needs

But what exactly is an identity theft protection company? And how can they help keep you safe?

Carry on reading below as we give you the low-down on what protection agencies do, which is the best identity theft guard service for you, and what actions you can take on your own to keep yourself protected.

What is identity theft?

Identity theft occurs when someone uses your financial or personal information without permission to commit fraud. Identity theft information can be used to take out loans or credit in your name or student loans in your name.

Common types of personal information targeted by criminals includes:

- Name

- Addresses

- Credit card details

- Banking details

- Medical insurance details

- Social Security Number (SSN)

Scammers can steal your information and identity through various ways, including online and offline. They might steal physical items like your purse or go through your trash for documents like bank statements and tax returns. Phishing is a common tactic where scammers send fraudulent messages, often posing as trusted representatives, to steal your information. They can do this via email, text message, over the phone, and by observing your social media profiles.

What identity theft protection services do

Identity theft protection services aim to prevent or lessen the impact of identity theft by monitoring for fraudulent activity relating to your personal information. They can help you recover from identity theft and prevent further consequences.

Here are some services provided by top identity theft protection services:

- Proactive monitoring: Constantly look for compromised personal information or potential fraudulent activity on the internet.

- Alerts: Notify you of any potential fraudulent activity relating to your personal information so you can intervene to prevent further damage.

- Credit monitoring: Flag any suspicious activity or unauthorized credit applications on your credit account.

- Reporting and investigation: Notify relevant parties or authorities—including credit bureaus, law enforcement, and legal practitioners—of fraudulent activity and assist with the resources and services needed for subsequent investigations.

- Identity restoration: Help you regain control of your personal information and accounts if you’ve been a victim of identity theft.

- Data security: Help you secure your sensitive information both online and offline using tools such as password management and data encryption.

Is identity theft protection worth it?

Yes, identity theft protection services are worth it. The growing shift to living life online has many implications. Along with your partner stalking you relentlessly and your potential employer monitoring how you present yourself on social media, spending time online also increases the risk of identity theft. The impact can be severe, affecting your finances, reputation, and credit. Identity theft protection services proactively monitor your personal information, intervene when necessary, and help you recover your stolen identity.

How to know if you need ID theft protection

The first question you might want to ask yourself when deciding if you need identity theft protection services is if you are at high risk of being targeted by ID thieves. ID theft protection services can often come at a premium cost, so before you go enrolling the service of the professionals, you should consider these steps you can take to protect yourself:

- Monitor your credit score through personal finance websites and keep an eye out for any changes to your credit report — if you see a change you haven’t anticipated then something might be wrong.

- Freeze your credit files at the major credit bureaus, preventing attackers from opening new fraudulent accounts.

- Report any identity theft attempts and follow the free directions given by the federal government at IdentityTheft.gov.

So, these are the steps that you can take on your own to help protect your identity from theft, but what exactly do ID theft protection companies do that you can’t do on your own? Here’s a quick list of what you can expect to get from an ID theft protection company:

- Alerts: Sometimes it’s way better to know as an attack has first started when you still have time to defend yourself. When protected by an ID theft protection firm, you will be alerted by their team whenever your personal information has been used, e.g. when someone tries to open a bank account in your name. Finding out before your cards have been fully depleted may give you the edge to cancel or freeze the account before the thief is able to make any further withdrawals — thus minimizing the damage and giving you a much better case to get your money back from the bank.

- Monitoring: The constant level of monitoring that you will receive from an ID theft protection agency will help keep you up-to-date and quick to respond should an attack be made on your data. The company will alert you as soon as it flags up on their system, giving you time to take action and protect yourself.

- Recovery: Most insurance policies that these companies can provide you will cover up to $1,000,000 in damages and lost money. This response is vital to protecting your credit score and minimizing the damage suffered in a cyber attack.

Best identity theft protection

Below, we will cover a range of different highly-rated companies on the market, which offer consumers ID theft protection services, and break down why they are good and what makes them unique. Use this information to perform your own comparisons and discover which business can offer you the most value, depending on your needs.

1. LifeLock

LifeLock | From $11.99 per month

If you want basic yet effective identity theft protection, LifeLock is a good option. LifeLock is Norton's identity theft protection service. You may be familiar with Norton—it’s a household name in cybersecurity solutions for mobile, Windows, and Mac devices.

Known for its trusted security, Norton’s LifeLock safeguards you across four key areas:

- Tax: protection During tax season, your personal information is shared with multiple parties, including with your accountant and employer. Due to the lack of control you have over your information, it becomes even more vulnerable to breaches, which can lead to identity theft. This is where LifeLock proves valuable by protecting you against identity theft and breaches.

- Restoration assistance: Unless your identity has been stolen in the past, you likely wouldn’t know what to do when you become a victim. During these incidents, time is of the essence, and acting fast could prevent further consequences, like financial losses. LifeLock assigns a personal specialist to help lighten the load and provide a clear roadmap to restoring your identity, minimizing further damage.

- Financial protection: LifeLock monitors financial institutions and services such as banks, credit bureaus, and credit card providers to detect identity theft they may overlook. And if you suddenly incur unexpected expenses as a result of identity theft, LifeLock also reimburses you to ease the financial burden associated with identity theft.

- Personal information monitoring: Since scammers and fraudsters are after your personal information, LifeLock proactively protects it to prevent you from getting implicated in financial and other crimes you’re not involved in. It also notifies you when your personal information appears on the dark web, allowing you to secure your accounts before they’re compromised.

LifeLock pays up to $1 million for legal and expert assistance, as well as reimbursement for stolen funds, ensures all your protection is comprehensive. Buy one of three plans starting at $11.99 per month or $89.99 annually.

2. Aura

Aura | From $10 a month

Aura is more than an identity theft protection service—it’s an all-in-one online safety tool that protects your finances, identity, devices, and family members (including seniors and kids).

Here’s what it offers:

- $1,000,000 insurance. Every adult member is covered for up to $1 million to help manage the payments and losses associated with identity theft.

- Certified data security and privacy. Aura uses the same security standards as banks and the military, giving you peace of mind that you’re using legit, best-in-class security systems trusted by top institutions. It also guarantees your data will never be sold to third parties.

- 60-day money-back guarantee. If you aren’t satisfied with Aura, they’re willing to give you a full refund within two months.

- 24/7 US-based support. US-based users have access to fraud specialists anytime, ensuring you can get help when you need it most.

Aura’ free 14-day trial allows you to time to determine if it’s the right solution for you before committing to a plan. Plans start at just $10 a month and vary depending on coverage for individuals, couples, families, and children. Some plans offer coverage for up to 10 to unlimited devices and up to $5 million in theft insurance.

3. ID Watchdog Premium

ID Watchdog Premium | $21.95 per month

What is the point of protecting your identity when your family members’ identities are vulnerable to fraudsters, cybercriminals, and bad actors? If protecting your entire family’s identity is important to you, ID Watchdog Premium could be a suitable solution. It protects the identities of you and your family by monitoring for signs of potential fraudulent activity across several data points, providing complete protection for your peace of mind. This service provides protection against a range of threats, including tax, medical, child, and criminal identity theft.

Examples of key features offered by ID Watchdog Premium include:

- Credit report monitoring: Depending on the plan you’ve purchased, ID Watchdog Premium keeps an eye on your credit reports from one or all three credit bureaus (Equifax®, TransUnion®, Experian®) and notifies you if it finds any suspicious activity.

- Dark web monitoring: Checks the dark web (chat rooms, forums, and websites) for signs that your sensitive information (including your SSN, email address, driver’s license, and more) was leaked.

- High-risk transaction monitoring: Prevents account takeovers by notifying you about high-risk activities performed by financial institutions in your name. These include new accounts, large withdrawals, wire transfers, and account holder changes.

- Subprime loans monitoring: Notifies you if anyone uses your identity to take out subprime, payday, rent-to-own, high-cost installment, or similar loans.

- Public records monitoring: Scans public records and other databases to determine if your identity is linked to new names or addresses, which could signal that someone has stolen your identity.

- USPS change of address monitoring: Keeps an eye on the United States Postal Service (USPS) National Change of Address database to identify any addresses linked to your name. Rerouting mail to an unknown address without your knowledge or permission is a common sign of identity theft.

ID Watchdog Premium is a standout solution for protecting families, not just individuals. Explore some of its key features that can help keep your children safe below:

- Child credit lock: Prevents lenders and creditors from accessing your child’s Equifax credit report, reducing the chances of your child becoming a victim of credit fraud.

- Child credit monitoring: Monitors your child’s Social Security Number on the Equifax credit database and notifies you of any credit files that pop up under their identity.

- Social account monitoring: Alerts you about potential cyberbullying or damaging information posted about your child on social media platforms like Instagram, Facebook, Twitter, YouTube, and LinkedIn.

ID Watchdog Premium offers up to $5 million in identity theft insurance—$4 million more than what most identity theft protection services offer. It also provides round-the-clock customer care and a dedicated resolution specialist to help resolve your identity theft case, ensuring you don’t feel alone when it matters most. For $21.95 per month, it offers one of the most comprehensive identity theft protection services available to protect your entire family.

4. IDShield

IDShield Family 3 Bureaus | $34.95 per month

If you have a full household and want to make sure your kids are protected when they are surfing the web and sharing messages online with their social followings. IDShield Family 3 Bureaus may be the best family identity theft protection. Not only do you gain access to instant alerts about changes related to fraudulent activity, but you will also gain access to a licensed private investigator as part of the package deal. Cover up to 10 kids inside one family plan with IDShield and make use of their VPN and malware protection services.

All this protection doesn’t come cheap, though, and this package doesn’t come with any form of discount for purchasing a year upfront.

5. IdentityForce

IdentityForce Ultra Secure+Credit | $23.99 per month

While this package may come with a higher price than some of the other competitors on the list, the Identity Force Ultra Secure+Credit plan comes equipped with various benefits. These benefits include robust credit monitoring, a VPN network for safe browsing, social media and cell phone monitoring and a whole host of other benefits.

One thing to remember before signing up with Identity Force Ultra Secure+Credit is that the credit reports are provided on a quarterly basis, unlike competitors who offer credit reports monthly.

6. Identity Guard

Identity Guard Total | $13.33 per month

Sometimes, speed is the only thing you need. If you are in a rush and just want to know which service has the fastest detection speed so that you can begin securing your defenses and countering the attack, then Identity Guard Total is our recommendation for you. It’s a trusted provider with a comprehensive monitoring system to ensure threats are detected quickly and efficiently.

Remember that with so much focus on speed, other areas like financial protection services will be ignored, unlike other choices on this list.

7. IdentityIQ

IdentityIQ | From $8.49 per month

While many identity theft protection services offer similar solutions, they may differ in approach and depth. Some work more like a bodyguard or advocate, actively defending you, updating you in real time, and remaining available when needed. That’s what IdentityIQ delivers.

IdentityIQ uses cutting-edge Artificial Intelligence software and local, national, and international law enforcement agencies to handle the heavy lifting of monitoring threats to your identity. It scans databases in 25 languages and billions of transactions to mitigate emerging threats before they cause serious harm to your finances or reputation.

Here’s what IdentityIQ monitors:

- Apps: When your sensitive information is either compromised or stolen, criminals and bad actors can use it to fraudulently open accounts in your name, including payday loans, credit cards, and utilities. IdentityIQ runs deep scans to check for identity theft by identifying fraudulent activity, including non-credit inquiries, and even flags unsuccessful attempts so you can take action before any more damage is done.

- Social Security Numbers (SSNs): Your SSN is a common target for tax fraud, credit card fraud, and other crimes. IdentityIQ monitors your SSN, and your children’s, in real time, alerting you if they’re used fraudulently.

- The dark web: The dark web is often used to trade stolen information. IdentityIQ partners with law enforcement, white hat hackers, former FBI agents, and AI technology to proactively monitor the dark web in real time, alerting you if your data appears on suspicious platforms.

- Change of address: IdentityIQ doesn’t limit its monitoring to traditional credit bureaus. It also flags suspicious activity that doesn’t involve your credit. Beyond the three major credit bureaus, it monitors more than 180,000 data furnishers, the USPS system, and the National Change of Address registry. Its tracker system allows you to monitor unauthorized address changes tied to your identity.

- Financial accounts: IdentityIQ looks for unusual spending patterns, unauthorized charges, and transactions from unknown locations, catching suspicious activity before major financial damage occurs.

- Credit: Unless you closely monitor your credit report, it’s easy to miss both small and significant changes that signal fraudulent activity. That’s why IdentityIQ keeps an eye on your credit health to assist in the identification of suspicious activity, such as hard inquiries, new accounts, or debt collection activity that might be linked to fraud, long before you take notice.

Other features include lost wallet assistance, ID restoration services for US-based subscribers, and the option to opt out of junk mail and call lists. If you want to add additional layers of security, IdentityIQ provides the option to bundle a VPN and antivirus program to your plan for an additional $2 per month.

8. IDX Complete

IDX Complete | $32.90 per month

Sometimes, you need a full-spectrum service to protect against identity theft and safeguard your privacy. That’s what IDX Complete is. It’s a robust solution focused on preventative measures, monitoring tools, and recovery services. Whether you’re proactively monitoring your accounts or responding to a breach, IDX Complete supports you at every stage.

IDX Complete offers the following benefits and services:

- Credit monitoring: Fraudulent credit activity can have serious consequences on your finances. IDX Complete monitors your credit reports to flag any changes, you can quickly act if you notice suspicious activity.

- Dedicated experts: Being a victim of identity theft can be both overwhelming and frustrating, especially when you don’t know where to start in resolving the matter. That’s where IDX Complete’s fraud resolution representatives step in, providing the support and expertise needed to resolve identity theft cases.

- CyberScan™: IDX Complete’s CyberScan monitors bulletin boards, chat rooms, and criminal websites for illegal sales involving your sensitive information.

- ID theft insurance: The financial impact of identity theft can set you back financially. IDX Complete reimburses subscribers up to $1 million in insurance to help cover the financial burden associated with recovery.

- Alerts: IDX Complete notifies you via email when there’s a change to your personal information, enabling you to act fast.

3. Clario Anti Spy

Clario Anti Spy | From $14.99 per month

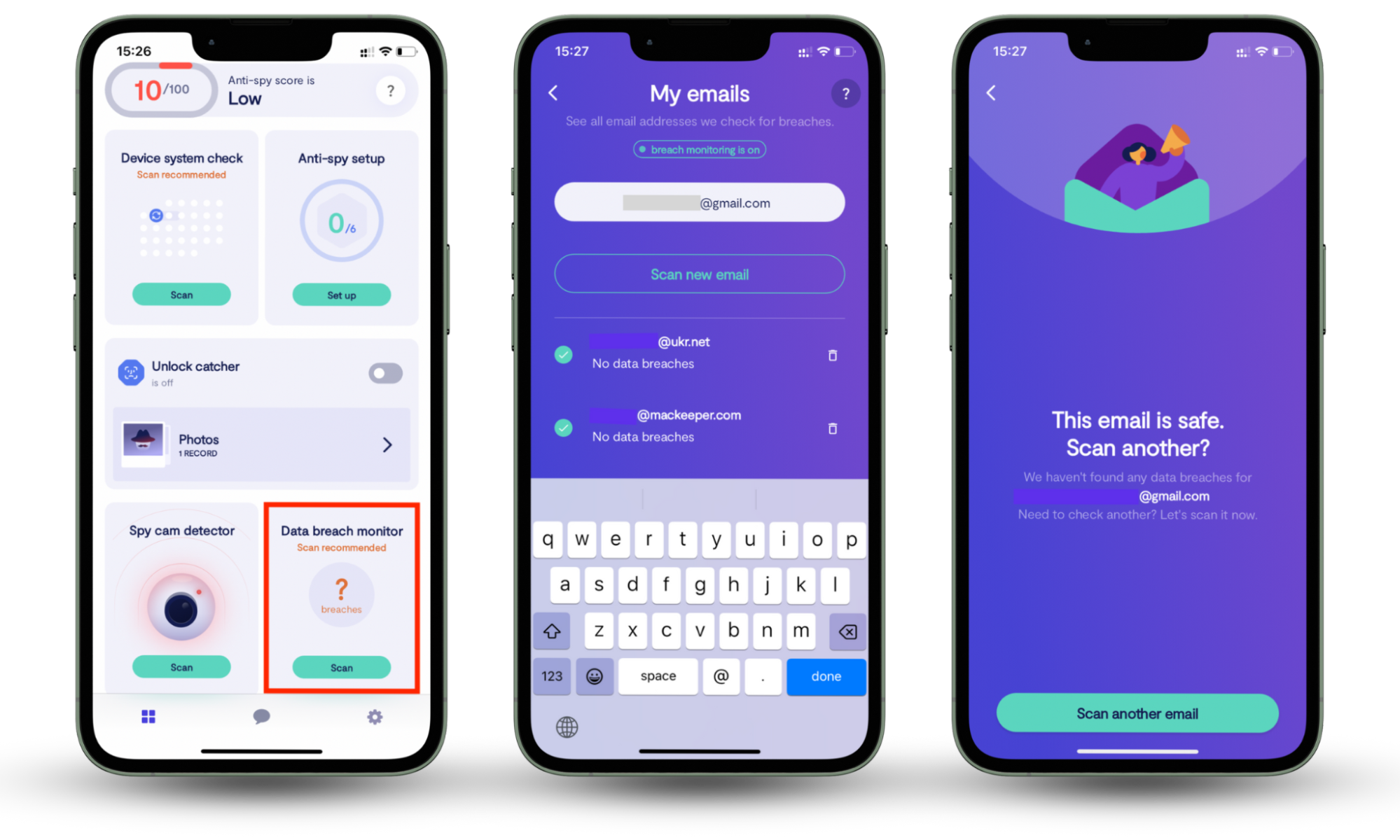

Keep your data safe online with the help of Clario Anti Spy’s anti-spying solutions. From emails, social media, credit scores, SSN, and medical records—Clario Anti Spy’s suite of privacy tools can help reduce the likelihood of your sensitive information landing in the wrong hands. For instance, our Data breach monitor constantly scans the web for data leaks containing your email address and notifies you when it is leaked or compromised so you can secure your online accounts.

Here’s how to get started using Clario Anti Spy’s Data breach monitor:

- Download Clario Anti Spy, get a subscription, and set up an account.

- In the app, click on Scan under the Data breach monitor feature.

- Click Check for breaches at the bottom of the screen. Clario Anti Spy will scan the web and notify you of any known breaches containing your email address. If your email was leaked, follow Clario Anti Spy’s prompts carefully to secure your email and its associated online accounts.

- Where applicable, select the option to Scan another email to check more email addresses.

Compare and choose the right identity theft protection service for your needs

All in all, identity theft can be prevented. When you look at each identity theft protection service that is available, there is a little something for everyone. As with any choice in life, make an informed one. Make sure you have read our identity theft protection services reviews carefully to avoid becoming a victim. The review will help you to understand the benefits and drawbacks of each service and choose the one that suits your needs and budget most accurately.

If you want your choice made easy, remember that you can confidently protect your online browsing with Clario Anti Spy’s comprehensive anti-spying protection. Clario comes with a long list of benefits designed to keep your data safe and security enhanced without incurring the highest costs, such as the Data breach monitor, which monitors your email’s vulnerability.