Table of contents

- What is Kroll Monitoring?

- What does Kroll Monitoring do?

- 1. Identity monitoring

- 2. Credit monitoring

- 3. Identity theft restoration and fraud consultation

- Is Kroll Monitoring legit?

- Features and benefits of Kroll Monitoring

- How much does Kroll Monitoring cost?

- What are risks associated with Kroll Monitoring?

- 1. Limited transparency and unclear data practices

- 2. Monitoring may be reactive rather than protective

- 3. Risk of scam impersonations

- 4. Inconsistent user experience

- 5. Limited scope of monitoring

- 6. Unclear or potentially high costs

- Who is Kroll Monitoring for?

- Is Kroll Monitoring good?

What is Kroll Monitoring?

Kroll Monitoring is a service offered by cybersecurity company Kroll that alerts you whenever it detects any activity involving your personal information. These notifications allow you to review the activity and take appropriate steps quickly if you suspect someone else is using your identity to obtain things like credit cards and loans in your name.

Kroll sends you an email as soon as it sees that your information is being used, allowing you to act quickly rather than waiting for potential identity theft to appear on your credit report. The sooner you report potential credit fraud or ID theft, the smaller the overall impact.

What does Kroll Monitoring do?

There are three key features that you can include in your Kroll Monitoring plan, all of which combine to protect you from data breaches, credit fraud, and identity theft:

Let’s take a look at each of these features in more detail to figure out whether Kroll Monitoring is the right service for you.

1. Identity monitoring

As part of its identity theft monitoring services, Kroll watches the internet to find any personally identifiable information (PII) associated with its subscribers. This includes:

- Email addresses and phone numbers

- Social security numbers

- Medical ID numbers

- Dates of birth

- Bank account numbers and routing information

- Credit and debit card numbers

2. Credit monitoring

Although it’s helpful to know when your information appears online, this doesn’t tell you when someone actually uses it—which is where Kroll’s credit monitoring service comes in. With this tool, you’ll receive an alert as soon as your credit profile changes in any way.

In other words, if a new credit card, loan, cell phone plan, or anything else appears on your credit report, Kroll will notify you immediately. It also looks for inquiries on your credit report, as well as things like address changes and other suspicious behavior.

3. Identity theft restoration and fraud consultation

The third key component of Kroll Monitoring is its identity theft restoration and fraud consultation services, which give you access to experts and help you figure out what to do after a data breach, identity theft, or credit fraud.

In addition to live assistance for any questions you might have, Kroll lets you connect with licensed investigators who can:

- Explain the identity theft restoration process

- Investigate and resolve fraudulent activity

- Issue fraud alerts to the Social Security Administration (SSA), Federal Trade Commission (FTC), and US Postal Service (USPS)

- Prepare documentation like dispute letters and complaints.

Is Kroll Monitoring legit?

If you’ve received a promotional email or seen an advert and you’re wondering if Kroll Monitoring is a real company, we can confirm it is indeed a legit business that offers tools for detecting and resolving identity theft and credit fraud.

These are the key factors we used to determine that Kroll is trustworthy:

- The Better Business Bureau (BBB) has accredited Kroll and awarded it an A rating.

- Large organizations and government agencies around the world rely on Kroll for identity monitoring after data breaches.

- Kroll has lots of positive reviews online, including from the likes of trusted sources like Gartner and G2.

Features and benefits of Kroll Monitoring

A big benefit of Kroll Monitoring is that it gives you access to licensed investigators and experts who help you check and analyze your credit report and spot identity theft or fraud.

Kroll Monitoring’s complete package includes:

- Constant monitoring to detect when your data appears online

- An alert system that notifies you as soon as a potential breach or other suspicious activity is discovered

- Support from experts and licensed investigators

- Access to educational resources that can help you protect yourself.

A service like Kroll Monitoring is particularly useful if you’ve been involved in a data breach and want to check if your personal information has been compromised. However, there’s a much simpler and more affordable way to find out if your information is being used by someone else.

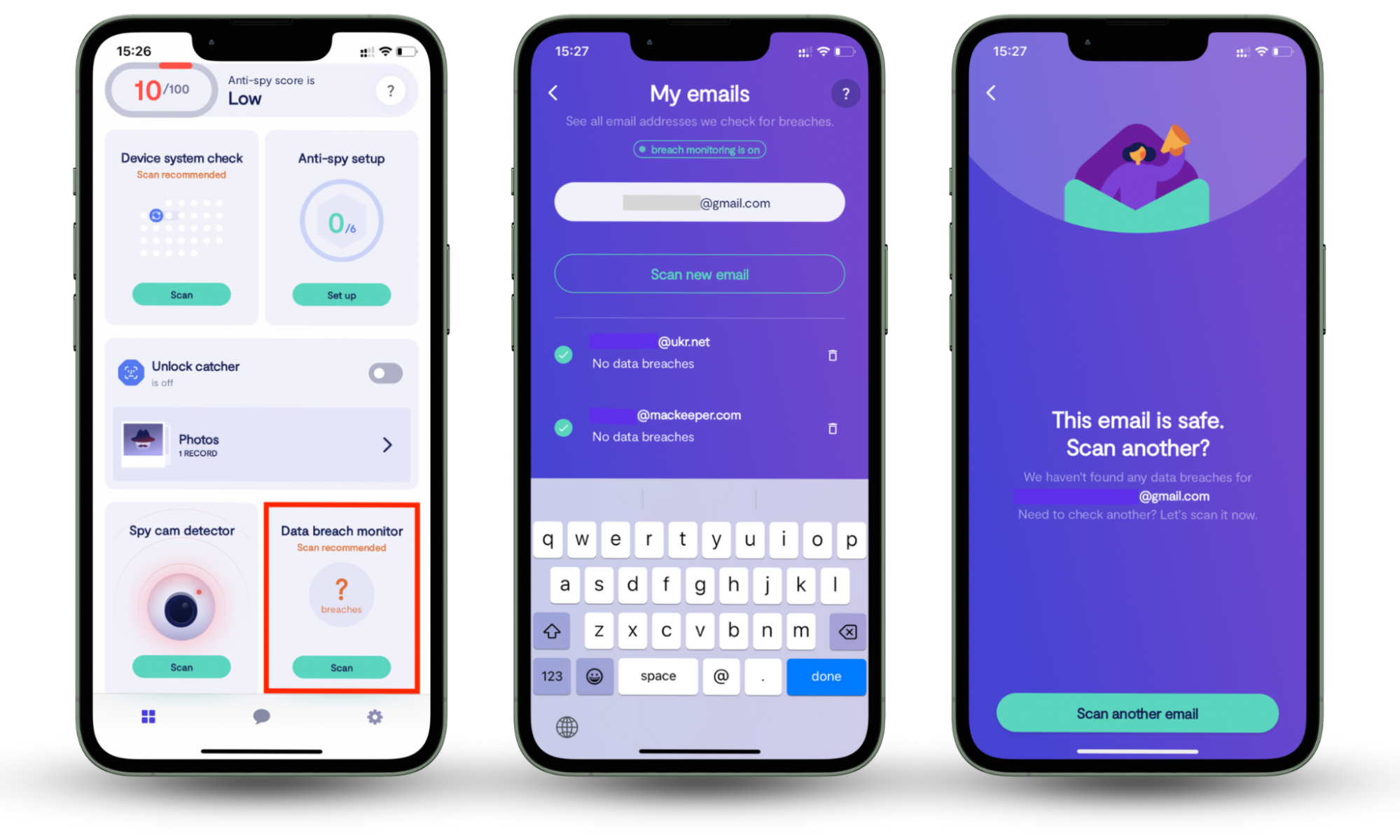

With Clario Anti Spy’s Data breach monitor on Android and iPhone, you can quickly find out if any sensitive data linked to your email addresses—the kind of data scammers can use to defraud you—is available online. Here’s how to use it:

- Download and install Clario Anti Spy on your Android or iOS device.

- Under Data breach monitor on the main screen, tap Scan.

- Check the list to see if your email has been involved in any data breaches.

- Tap Scan new email to check another address Clario isn’t aware of.

How much does Kroll Monitoring cost?

Kroll Monitoring is sometimes provided for free for up to two years—to those who have become the victim of a data breach (paid for by the company that leaked their data, usually as a way to apologize to customers). But if you want to continue using it, there is a price to pay.

Unfortunately, the actual cost of Kroll is difficult to determine since the company doesn’t publish a transparent pricing structure. In fact, we found it near impossible to find pricing anywhere online, so you’re forced to contact Kroll if you want to use its service. Some reviews say, however, that it’s not cheap.

What are risks associated with Kroll Monitoring?

Although Kroll is a legitimate company that partners with major organizations, it’s important to understand that there are risks associated with its Monitoring service. These include:

- Limited transparency and unclear data practices

- Monitoring may be reactive rather than protective

- Risk of scam impersonations

- Inconsistent user experience

- Limited scope of monitoring

- Unclear or potentially high costs

1. Limited transparency and unclear data practices

Kroll is keen to advertise the many tools and services it offers to help you avoid identity theft and credit fraud, but there is limited information available about how Kroll Monitoring actually works. The company doesn’t disclose how it looks for your info online or the sources it uses.

2. Monitoring may be reactive rather than protective

The range of services Kroll provides focuses on reacting to data leaks and identity thefts that have already happened rather than offering protection against instances that could occur in the future. It doesn’t offer an antivirus or block malware that hackers use to steal your personal information.

3. Risk of scam impersonations

Because Kroll typically reaches out to potential customers by email or post, scammers have discovered that they can trick people into handing over valuable information by pretending to be Kroll and taking the same approach. This has made it difficult to tell whether a message from Kroll is genuine or a scam.

4. Inconsistent user experience

Not all the online reviews we read on Kroll Monitoring are positive. While some customers enjoy a good experience, others have negative things to say about the effectiveness of Kroll’s identity monitoring tools, the difficulties they face reaching customer support, and signup issues that are difficult to overcome.

5. Limited scope of monitoring

Kroll doesn’t tell customers whether its monitoring service covers all three major credit bureaus (Experian, Equifax, and TransUnion) when looking for potential credit fraud. The problem with this is that not all lenders report to every bureau, which means there are likely gaps where fraud can go undetected.

6. Unclear or potentially high costs

While it seems that most Kroll Monitoring customers sign up to take advantage of free coverage, this is usually offered for a limited period of time. If you continue using the service after this point, you’ll need to pay for it, and while some say Kroll is expensive, the actual costs of its tools are not available online.

Who is Kroll Monitoring for?

Kroll Monitoring is for anyone who worries about identity theft and credit fraud. It is typically purchased by large organizations looking to protect customers after a data leak meaning that their information is exposed, but individuals can also buy Kroll Monitoring to receive alerts when potential threats are found.

Is Kroll Monitoring good?

Many customers consider Kroll a good company, and its Monitoring tools are useful for detecting identity theft and credit fraud. However, it’s important to remember that not all Kroll Monitoring users have enjoyed a positive experience, and key aspects of its approach are unclear.

One thing Kroll hides is its pricing, and many users report it’s expensive. A more affordable and much simpler way to check for data breaches that can lead to ID theft is with Clario Anti Spy’s Data breach monitor on Android and iOS. Try it out today to protect your information.