Table of contents

- Understanding the risks of Social Security Number theft

- Steps to take if your Social Security Number is compromised 40

- 1. Place credit freeze or set up fraud alert

- 2. Report identity theft to FTC and notify law enforcement

- 3. Notify companies of fraudulent activity involving your SSN

- 4. Monitor your accounts and credit reports

- Is there a way to protect your Social Security Number?

- Conclusion

Understanding the risks of Social Security Number theft

Cybercriminals and other bad actors can further their criminal activities with your SSN, such as applying for credit in your name without your knowledge, lowering your credit score, and leaving you to pick up the pieces alone. Another example is accessing your emails and linked online accounts, which contain sensitive data like your banking information.

When that happens, the responsibility to dispute the credit applications, clear your name, and open a case of fraud lies on you. Opening credit accounts in your name is only a fraction of what someone can do with your SSN.

Steps to take if your Social Security Number is compromised 40

Here’s what to do if your SSN is compromised:

- Place a credit freeze or set up a fraud alert.

- Report identity theft to FTC and notify law enforcement.

- Notify companies of fraudulent activity involving your SSN.

- Monitor your accounts and credit reports.

If your Social Security Number has been stolen, here’s what to do: protect yourself from identity theft to avoid getting implicated in further scams. Here are four steps you can follow:

1. Place credit freeze or set up fraud alert

Immediately initiate a credit freeze when you suspect someone has stolen your SSN in a social engineering scam. This prevents further damage by setting up fraud alerts, which will block the scammer from pulling your credit report, stealing your identity, and opening new credit accounts in your name. In addition, it will prompt creditors to verify your identity before processing credit applications.

However, be warned that credit freezes permit some third parties to access your credit report, including:

- Landlords

- Card issuers

- Debt collectors

- Current lenders

- Rental agencies

- Prospective employers

- Child support agencies

- Government agencies serving warrants and court orders

2. Report identity theft to FTC and notify law enforcement

If your Social Security Number has been stolen, file a report. The FTC assists identity theft victims in recovering their SSNs after a breach or hacking incident. Report the theft with identitytheft.gov, which will help you start your personal recovery plan. You may have to provide key details, including what the hacker used your sensitive information for and how they misused it.

If you know who stole your SSN, consider filing a report with law enforcement. This can help your case if the scammer uses your SSN to commit crimes.

Ensure you have the following information to report a compromised Social Security Number to law enforcement:

- Your identity theft report with the FTC

- Evidence that your identity was stolen

- Proof of address

- Government-issued photo ID

3. Notify companies of fraudulent activity involving your SSN

Your next mission is to notify the companies where the scammer used your SSN about fraudulent activity involving it and stop ongoing processes.

Below are the organizations you can report a compromised Social Security Number to:

- Existing creditors to dispute unauthorized accounts or fraudulent transactions

- New creditors to explain that you didn’t authorize the opening of new accounts and have them shut down

- Government agencies to flag fraudulent identification records

- Medical providers to resolve fraudulent claims or bills related to identity theft

4. Monitor your accounts and credit reports

Reporting identity theft to authorities and organizations is only half the job done. Another essential step is continuously monitoring your accounts and credit reports to ensure the scammer doesn’t persist in misusing your SSN.

Here’s how you can keep an eye on your SSN:

- Destroy documents containing your SSN

- Always verify recipients before sharing your SSN

- Never store your SSN on your devices or somewhere accessible

- Regularly review your Social Security statements for suspicious activity

- Avoid repeating the same password across multiple accounts containing your personal data

- Use multi-factor authentication and strong passwords to protect documents containing sensitive information

- Never make the mistake of accessing your online banking or other personal accounts while connected to public Wi-Fi networks

- Periodically check your credit reports from companies such as TransUnion, Experian, and Equifax for suspicious activity

Following the steps outlined above can help protect your Social Security Number from further compromise. However, if a bad actor obtained your SSN from a breached email, chances are another scammer can do the same.

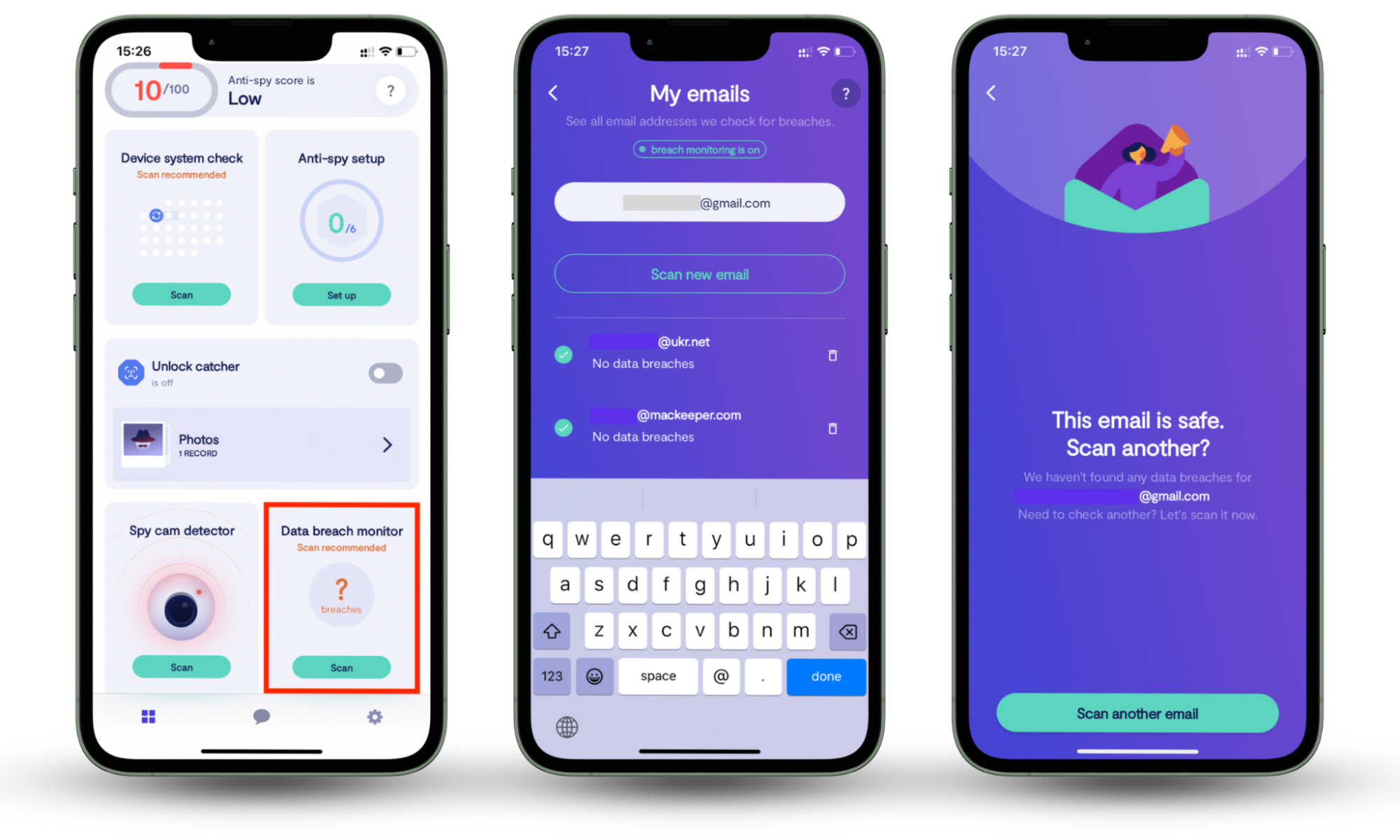

For this reason, I advise you to secure and monitor your email using Clario Anti Spy’s Data breach monitor. This cybersecurity solution helps you proactively protect your sensitive information by scanning the dark web for data leaks containing your email address and notifying you when it finds them. It empowers you to promptly take back control of your email address and secure all other sensitive information linked to it by following Clario Anti Spy’s instructions.

Follow these steps to determine if your email address was leaked in a breach:

- Download Clario Anti Spy on your iOS or Android device and set up an account.

- In the app, navigate to Data breach monitor and tap Scan.

- Clario Anti Spy will report what it finds. If your email was breached, follow the prompts to secure it. If not, you can scan another email. Either way, Clario Anti Spy will monitor your nominated email address. This can help protect your SSN and other sensitive information in your emails.

Is there a way to protect your Social Security Number?

Avoid carrying your Social Security card with you—it’s safer to memorize it instead. Never produce your Social Security card publicly or share it with unauthorized parties. Always verify the recipient before providing your SSN. Don’t click on pop-ups and banners in your browser or links you receive in emails, text messages, or social media accounts. Likewise, delete or block emails with suspicious attachments or from unknown senders.

Conclusion

Your SSN is one of the most private pieces of data you own. Therefore, knowing what to do if your Social Security Number is stolen is crucial. If a scammer or unauthorized person obtains your SSN, prioritize placing a credit freeze or setting up a fraud alert. Report a stolen Social Security Number to the FTC and tell law enforcement and affected organizations about it. Finally, monitor your accounts and credit reports closely to ensure bad actors don’t continue to use your SSN.

However, relying on these methods can cause you to catch cases of identity theft much later. Therefore, I recommend you monitor your email address using Clario Anti Spy’s Data breach monitor. Since your email contains sensitive information such as your SSN, securing it is essential for preventing identity theft.