Table of contents

- What are Facebook scams

- How do Facebook scams work

- How to recognize Facebook scams

- Common scams on Facebook

- 1. Fake prizes and giveaways

- 2. Clickbait scams

- 3. Fake coupon codes

- 4. Facebook Messenger scams

- 5. Fake fundraisers and donation scams

- 6. Facebook quiz scams

- 7. Fake job offers

- 8. Marketplace scams

- 9. Romance scams

- 10. Cash app scams

- 11. Rental scams

- 12. Accounts promoting cryptocurrency investments

- 13. Hacked or cloned accounts asking for 2FA codes

- 14. Puppy scams

- 15. Ticket scams

- How to avoid Facebook scams

- Conclusion

What are Facebook scams

Facebook scams are fraudulent schemes created to deceive users into sharing their personal information, sending money to a scammer, or clicking on malicious links. The most common scams include phishing, fake giveaways, catfishing, and online marketplace scams.

On Facebook, you can be scammed through Messenger, fraudulent posts and pages, and, of course, Facebook Marketplace. To avoid Facebook scams, staying vigilant is essential—verify accounts you're in contact with, avoid clicking suspicious links, and enable privacy settings like 2-factor authorization (2FA) to stay protected.

How do Facebook scams work

There are several ways that scams can work on Facebook, depending on whether they’re undertaken through a message, a post, or a platform. However, every kind of scam involves some sort of social engineering scheme. They are designed to manipulate human vulnerabilities by preying on generosity, curiosity, or fear.

According to the Federal Trade Commission, reported losses to scams on social media from January 2021 to June 2023 hit a staggering $2.7 billion, far higher than any other platform or attack method. With over three billion active users, Facebook has a ready pool of victims for fraudsters. Scammers take a shot in the dark, targeting several thousands. Even if just a few of those targeted fall into their traps, this will be considered a success.

Here are some common types of Facebook scams and their potential consequences:

- Account takeovers: Hackers gain access to Facebook accounts to impersonate users in order to scam their friends or get sensitive information for identity theft or extortion.

- Fake ads and marketplace scams: Fraudsters post fake ads or marketplace deals to make their victims send payments on platforms like Venmo or PayPal. It is typically harder to get refunds or reverse charges with these payment providers.

- Phishing links: Scammers send links in direct messages or emails regarding Facebook notifications. These can let them upload malware on your device and even grant hackers remote access to your device.

- Personal data theft: Personal information such as birth dates and hometowns can be scraped off Facebook for identity fraud or sale on the Dark Web.

- Romance and job scams: Con artists make a profile and, through trust-building, take money or other sensitive information that results in emotional distress and financial loss.

If you’ve ever received a random text from a friend asking for a small financial loan or requesting access to your Facebook account, you’ve likely encountered these scams. As absurd as these requests may sound, they often succeed because they exploit our natural instincts to trust and help others.

Example from my own personal experience

Some years ago (I was seventeen, I recall), I received a message from my friend's Facebook account saying, 'Help! I'm locked out of my account. Can you help me reset it?' At the time, it sounded quite plausible until the scammer subsequently hijacked my personal profile. This experience underlines the importance of vigilance online, especially for certain age groups and those who are unaware of online threats. Seniors are easy prey, too. This is why scammers often exploit their trust and relative unfamiliarity with online threats.

How to recognize Facebook scams

Current Facebook scams use all sorts of tricks to part their victims from their money, but many come with common warning signs. New data from cybersecurity firm F-secure estimates that about 62% of Facebook users encounter scams every week. Knowing what to look out for can save you from becoming one of the victims.

Here's what to watch for to avoid Facebook scam:

- Financial red flags. Untraceable payment requests. A red flag would be if someone asked you to send money by gift cards, any payments via an app, or wire transfers. These methods are very hard to trace and refund. Tip: Only use the payment options on Facebook or any secure, traceable transaction method.

- Profile red flags. Most scammers make fake accounts that barely have any activity. Be wary of profiles with low friend counts, just a few posts, or only a couple of photos. Example: If a profile picture looks too professional or generic, do a reverse image search to see if it's stolen.

- Message red flags. Ill-conceived messages and those that rush you to take urgent action may be scams. Urgency works in these scenarios; most times, victims end up making decisions when there is not enough time for reasoning or thinking anything through. Tip: It only costs a minute more to look into such messages, even from people you know. Just call them from another line if needed.

- Impersonation attempts. Fraudsters can create a profile similar to that of your friend or family member. Then, they will message you for money or sensitive information. Tip: It is very important to thoroughly check the profile; if you doubt it’s real, approach your friend through other means to confirm their intentions.

- Phishing links: A link that comes through Facebook Messenger or email may claim to be an urgent notification. These links may download malware or take you to phishing sites. Tip: Hover over the link to reveal the link address and verify the source before clicking (this only works on desktop computers).

By watching out for these warning signs and using some basic common sense, you can lower your chances of falling prey to Facebook scams.

Common scams on Facebook

Lucky for you, dear reader, I have outlined the most common Facebook scams raging out there, waiting to defraud you. Look out for these 15 common Facebook scams:

- Giveaway scams

- Clickbait scams

- Fake coupon codes

- Facebook Messenger scams

- Fake fundraisers and donation scams

- Facebook quiz scams

- Fake job offers

- Marketplace scams

- Romance scams

- Cash app scams

- Rental scams

- Accounts promoting cryptocurrency investments

- Hacked or cloned accounts asking for 2FA codes

- Puppy scams

- Ticket scams

1. Fake prizes and giveaways

Fraudsters often use fake giveaways and prize announcements to lure their victims. They mostly impersonate popular brands, celebrities, or even lotteries and promise some juicy rewards, such as cash prizes, vacations, or high-end gadgets. They ask victims to engage by liking, sharing, or filling out forms with personal information. For instance, scammers might hold a 'lottery' that requires you to pay an upfront fee for 'processing' or 'shipping.'

How to identify it: Usually, fake giveaways are hosted by spoofed pages with low or very recent activity. They might tell you that you won a prize for which you never enrolled. And, of course, no legitimate giveaway would ever require any type of advanced payment.

How to avoid it: Verify all giveaways through the official page of an organization or person. Never give out personal information, and do not pay for 'free' prizes in advance. Check out the URL for the giveaway link. Scammers often use misspelled domain names—one letter off—so that they sound and appear to be some well-known brand (e.g., amazzon.com).

2. Clickbait scams

These are the scams banking on clickbait headlines such as 'You won't believe what this celebrity did!' through which a victim is lured to a website with malicious intent, either to install malware or phish personal information.

How to identify it: You click on a post with an out-of-this-world story about a celebrity scandal and end up on a website asking you to download or sign in with your credentials. Or, you discover a 'breaking news' post about a natural disaster. When you click the link, it takes you to a phony donation page that collects your credit card information.

How to avoid it: Avoid sensational headlines. Hover over URLs to check their validity (this is only possible on laptops or desktops), and always question 'over-the-top' claims.

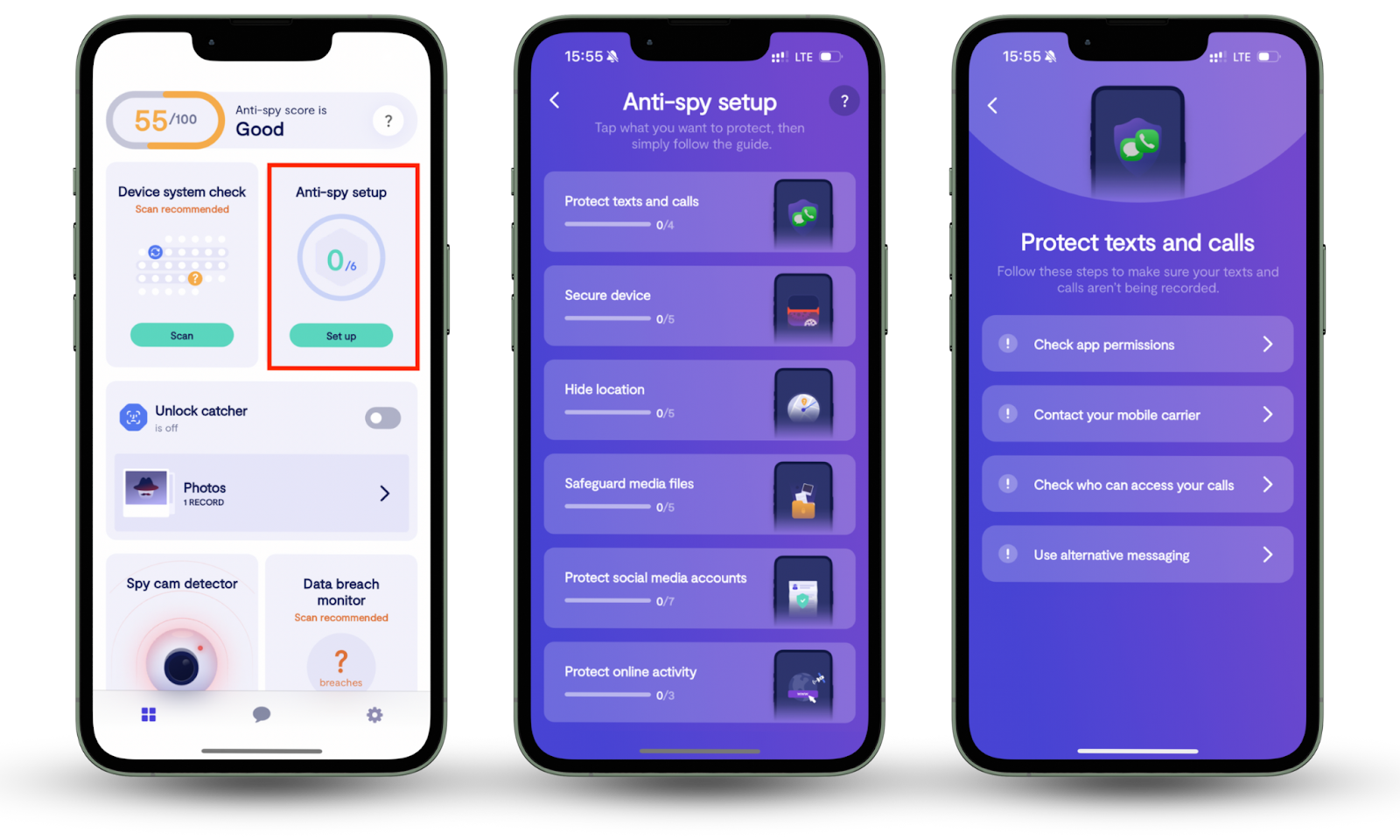

Apart from educating yourself on the dangers of Facebook scams, there is another efficient solution for protecting yourself, your device, and social media accounts. Use Clario’s Anti-spy setup to adjust your phone’s security settings and make your device secure and private.

Here’s how to use Clario’s Anti-spy setup to protect your social media accounts:

- Download Clario Anti Spy and get a subscription to create an account.

- Click Anti-spy setup and follow the instructions.

- Adjust your device settings to protect yourself from hacking.

3. Fake coupon codes

Scammers often promote fantastic deals from major retailers, which can be tempting, but the goal is to get you to disclose personal information or install malware rather than snag a bargain. For example, such an ad may be advertising a $100 coupon for groceries and require users to send forms with personal data.

How to identify fake coupon scams: They promote coupons through unofficial channels; you cannot confirm the source, and the website asks for personal details.

How to avoid fake coupon scams: Validate offers on a merchant's website. A deal that's too good is probably just that. Try using legitimate browser extensions, like Groupon or Rakuten, to find coupons instead.

4. Facebook Messenger scams

These are run by hacked or cloned accounts and contain texts with malicious links or urgent requests. One of the most common messages is a variation of the 'Is this you in this video?' message, which leads to malware uploading onto your device when you click the link.

How to spot Facebook Messenger scams: Messages are vague, highly emotive, or urgent and are sent from accounts of people you haven't talked to in some time or have never spoken with.

How to avoid Facebook Messenger scams: Verify suspicious messages by contacting the sender through another platform. Avoid clicking on unexpected links (even from friends), and learn how secure Facebook Messenger is.

5. Fake fundraisers and donation scams

Scammers play on user empathy with fake fundraisers for medical emergencies or charity fundraisers organized immediately after disasters or tragedies. Tales of children needing lifesaving surgery prompt many well-meaning donations into the pockets of fraudsters.

How to identify fake medical fundraisers: These posts usually don't have extensive verifiable information or links to a legitimate charity organization. Also, there is usually a lack of transparency around how funds will be used.

How to avoid fake medical fundraisers: Pay only via a legitimate website and investigate the organizers before donating. Before donating, look for social proof, such as comments from verified users or endorsements from known organizations. Be wary of fundraisers that require urgent deadlines. For the most part, legitimate charities do not pressure donors.

6. Facebook quiz scams

These innocent-looking quizzes ('What's your superhero name?') solicit answers that are similar to common security questions, allowing identity theft. Are you using your pet’s name as a password? Well, don’t.

Fraudulent quizzes always come with advertisements redirecting players to phishing sites. Be wary of any quizzes that forward you to third-party sites.

How to spot quiz scams: Questions ask for personal information that people often use as their security questions, such as your mother's maiden name or your first pet's name.

How to avoid quiz scams: Steer clear of quizzes that want personal information. Only use games from popular, well-known brands.

7. Fake job offers

Fraudulent job ads offer great pay and perks for very little required work. Scammers want personal information such as bank account details or insist on an up-front fee to process your application.

How to identify fake job offers: If you see a job opening advertising a remote position requiring a $50 registration fee, that’s likely to be fake.

How to avoid fake job offers: Research employers on trusted platforms like Glassdoor or Indeed, and don't apply for jobs that sound too good to be true. Look for company reviews to confirm its legitimacy. No valid employer will ever request personal financial information upfront without signing a contract that protects both parties.

8. Marketplace scams

Scammers list fake deals on Facebook Marketplace, often for big-ticket items at unreal prices. They insist on taking payments through untraceable channels, like PayPal, after which the stuff never arrives.

How to spot marketplace scams: Be wary of red flags, such as someone listing items at unrealistically low prices, sellers trying to avoid Facebook's payment system, or requesting gift cards.

How to avoid marketplace scams: Only choose secure modes of paying and view the seller’s profile before making any transactions.

9. Romance scams

Facebook is no Tinder, but Tinder swindler scenarios are still possible on other social media platforms. Scammers create fake profiles and build an emotional rapport to deceive victims out of money.

How to identify romance scams: Someone you’ve been talking to online is telling you how rich their family is and how hard it is for them to try and make it by themselves. Eventually, they ask you for small loans and keep their family’s wealth as collateral.

How to avoid romance scams: Most romantic scams use stolen photos from public profiles. Reverse image searches can help identify fraudulent profiles. Generally, have your guard up when meeting people online. You should never send money to anyone you haven't met in person.

10. Cash app scams

Posts that promise to 'flip' small Cash App payments into larger sums are classic scams. The fraudsters will take the money and disappear. I know how attractive it may sound, but you need to stay realistic—no one is going to turn your $200 into $1,000 for free.

How to identify Cash app scams: That is the easiest—if someone offers guaranteed financial returns with no risk involved, then it’s a scam!

How to avoid Cash app scams: Ignore schemes promising unrealistic returns and only transact with verified users, like your friends and family. If you cannot help falling for no-risk profit tales, just try investing in stocks or investment funds instead. The profit won’t be immediate, but you will at least get some as opposed to completely losing your money.

11. Rental scams

Scammers list rentals for properties that are not on the market or simply don't exist. Victims pay deposits upfront and discover they’ve been scammed when they try to move in.

How to spot a rental scam: Listings are usually way under current market asking prices and require payment with no showing.

How to avoid a rental scam: See properties in person and only use verified rental services and realtors.

12. Accounts promoting cryptocurrency investments

Scammers tempt victims with fake crypto-investment schemes and promise unreal returns. They sometimes even allow small initial withdrawals to gain the confidence of people before disappearing along with major portions.

How to identify crypto-investment scams: 'Guaranteed 300% returns on Bitcoin investments!!'—that’s a post you need to run from. There is nothing guaranteed about cryptocurrencies.

How to avoid crypto-investment scams: Research investment opportunities thoroughly and avoid unsolicited offers or offers that seem too good to be true.

If you’ve recently googled ‘cryptocurrency investments’ and now you are suddenly getting spammy crypto-investment ads, it’s time to wonder if Facebook spies on you.

13. Hacked or cloned accounts asking for 2FA codes

Scammers compromise or clone accounts; then, using the hacked/composite accounts, they reach out in attempts to hoodwink users into giving out sensitive information, such as 2FA codes. Other variants involve messages coming from a friend in apparent distress needing help to log into an account.

How to identify 2FA codes scams: You get a request for 2FA codes, most especially from someone claiming it was sent to the wrong email. Your genuine friends and organizations will never request such a code.

How to avoid 2FA codes scams: Never give out your 2FA codes to anybody. Never. Otherwise, hackers or scammers will be able to break into your email and social accounts. From there, they will most probably gain access to your online banking.

Curious how Facebook accounts get hacked? Read our blog to find out.

14. Puppy scams

Fraudsters post fake pet listings, often purebred puppies, for very low prices. Victims pay upfront but never receive the pet.

How to spot puppy scams: Those listings that have too-good-to-be-true pricing and sellers who refuse to meet in person are most probably scammers.

How to avoid puppy scams: Only buy pets from trusted breeders or adoption agencies.

15. Ticket scams

Scammers sell fake tickets to popular events. Victims realize the fraud only at the venue entrance.

How to detect ticket scams: Tickets sold at prices significantly below face value or through non-standard channels are clear red flags.

How to avoid ticket scams: Buy tickets exclusively from authorized platforms or resellers.

How to avoid Facebook scams

I’ve gathered some practical strategies to keep your account and online activities safe.

Strengthen account security:

- Use strong, unique passwords: Create complex passwords combining uppercase and lowercase letters, numbers, and symbols. Avoid using the same password on multiple sites and platforms.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security by requiring a verification code along with your password. Use options like push notifications, fingerprint scans, or hardware security keys.

- Update backup contact details: Ensure your account recovery options, such as backup email addresses and phone numbers, are current and accurate to regain access if hacked. Use our blog to learn how to tell if your Facebook profile has been hacked.

- Enable login alerts: These can be set up through Facebook so you receive a notification whenever a login from an unfamiliar device or location occurs.

Monitor account activity:

- Check your login and active sessions: View your login history to see if there are places or actions you don't recognize, like liking posts or adding friends.

- Follow up using the Security Checkup Tool: This tool allows reviewing account settings and adding recommended security features from one place.

Be careful with links and messages:

- Steer clear of suspicious links: Never click on links that show up via unsolicited DMs, emails, or texts-even from friends. These are very often sent by scammers from a compromised account.

- Verify requests for money or information: If a request for sensitive information or money suddenly appears, decline it. Always verify it with the person concerned through a different means.

- Decline friend requests from strangers: Accepting requests from unknown profiles often exposes you to fraud. Also, beware of friend requests from people you're already connected with—such requests could be from cloned accounts.

Identifying and reporting Facebook scams:

- Know the scenes of common scams: Learn to recognize common scams—fake giveaways, phishing, and cloned accounts.

- Report suspicious activity: Use Facebook's features to report scam posts, profiles, and messages. Reports are an effective method for helping Facebook investigate and remove malicious accounts from its site.

Practice privacy online:

- Set your privacy to show your posts and personal data to a small group of people: This will minimize the chances of scammers contacting you.

- Limit sharing your personal information: Avoid putting sensitive information such as your phone number or address on your profile or posts.

- Be careful with quizzes: Watch out for those quizzes that ask for information that sounds like common security questions. For example, 'What was your first pet's name?' Those could be data-harvesting schemes.

Stay vigilant with transactions:

- Watch out for too-good-to-be-true offers: If an offer or ad has a suspiciously generous offer, do your research on it or consult with a trusted friend before engaging.

- Use only secure payment options, and conduct the transactions on trusted traceable platforms. Do not pay via gift cards and payments that are outside of payment services.

- Monitor bank statements and credit reports: If you suspect a scam, monitor your accounts for unauthorized transactions or new credit accounts in your name. Immediately report the fraud to your financial institution.

Take these measures to drastically reduce the likelihood of being targeted by a Facebook scam and keep yourself safe online.

Conclusion

Protecting yourself against Facebook scams requires vigilance and proactive measures. Educate yourself on the various types of Facebook scams out there and how they work—this will be your first line of defense. However, since, from my personal experience, I know that knowing that scams exist is not enough to avoid Facebook scams, my best advice would be to practice good online hygiene.

Use strong passwords, enable 2FA and login alerts, and avoid suspicious links and messages from accounts you do not recognize. For more efficient protection, use Clario’s Anti-spy setup to protect your device and social media accounts.