Table of contents

- Is online banking safe?

- What are the risks of online banking

- How does an online bank work?

- Tips for using online banking safely

- 1. Use strong passwords

- 2. Don't give out your passwords

- 3. Don't use unsecured public Wi-Fi

- 4. Turn on two-factor authentication

- 5. Never click on suspicious links

- 6. Update online banking on time

- 7. Enable bank notifications

- 8. Use reliable financial applications

- 9. Check your bank accounts regularly

- 10. Keep your antivirus software up to date

- Conclusion

Is online banking safe?

Online banking is generally very safe, but it depends on both the bank and the user. Reputable banks use a range of high-security protections, including military-grade encryption and real-time monitoring for suspicious activity. These features make it incredibly hard for criminals to access your accounts or steal your money.

However, these security measures only work when paired with safe and responsible behavior. If you aren’t careful, you might expose yourself to risks like hacking and identity theft, which can make online banking less secure.

The biggest threat to your bank accounts comes from phishing scams, which we’ll explain below. The problem is, if one of your online accounts is compromised, your bank account might be too. That’s where online banking can become less safe—unless you’re aware of the risks and act safely online.

What are the risks of online banking

The major risks of online banking include:

- Phishing attacks. Scammers use different types of scams online, including phishing attacks. In these, scammers send messages, emails, or phone calls appearing to be from your bank. They try to trick you into sharing personal information like your login details or financial credentials.

- Data breaches. Cybercriminals hack into company systems and try to steal customer data. If successful, they might locate your account numbers, personal identification, and passwords, using these to hack your account and steal your money. If you’re worried about data breaches, use Clario Anti Spy’s Data breach monitor to find out whether people are selling your personal information online.

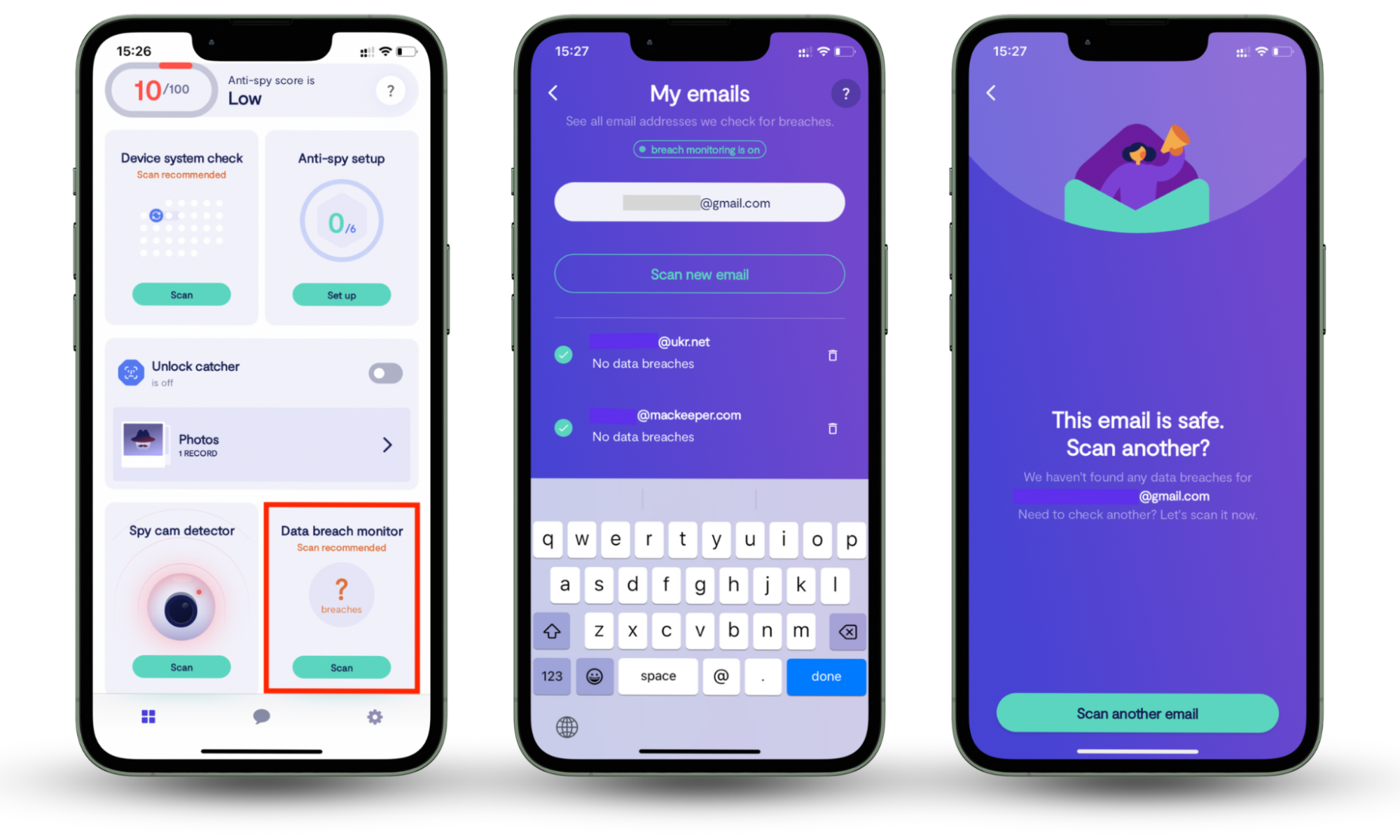

To use Clario Anti Spy’s Data breach monitor, follow these instructions:

- Download Clario Anti Spy and create an account.

- Under Data breach monitor, click Scan.

- Type your email address in and click Scan.

- If Clario Anti Spy finds any breaches, follow the on-screen instructions to return to safety.

- Identity theft. If a scammer steals your personal information, they can commit identity theft and gain access to your accounts. Once they’re in, they might transfer your money to another account or make purchases online. Identity theft prevention involves safe online banking practices.

- Malware infections. Fraudsters use social engineering tactics to convince people to download malicious software like viruses and spyware. Once malware infects your device, it can collect your personal information and send it back to the scammer.

How does an online bank work?

An online bank operates through digital platforms, like websites and mobile apps. They let you manage your finances and transfer money without visiting a physical bank branch. When you sign in to the bank’s online dashboard, you can see account balances, transaction histories, and account details. You’ll also be able to transfer money between accounts, send money, and deposit checks.

Tips for using online banking safely

To keep your money safe, you need to know what you should do when shopping and banking online.

Here are some security measures to secure your bank accounts:

1. Use strong passwords

Your passwords are the first line of defense against would-be hackers and scammers. If you use the same weak passwords across your online accounts, you increase the chances of a scammer getting access. To make your passwords stronger, your passwords should be:

- At least 12 characters long

- Made up of a mixture of letters, symbols, and numbers

- Unique—never reuse passwords!

- Random—don’t use easy-to-guess combinations like birthdates or pet names

It’s also important to change your passwords regularly. These days, security breaches happen all the time when hackers steal passwords and user information and sell it on the Dark Web. To prevent this from happening, change your passwords every few months. A password manager can help you store and remember your passwords securely.

2. Don't give out your passwords

Keep your passwords safe and private. Never share your passwords, phrases, or PIN codes with anyone, even if you think they’re trustworthy. If someone asks for your password over email, text, or phone call, it’s probably a scam. Ignore them and block the number immediately.

3. Don't use unsecured public Wi-Fi

Using public Wi-Fi for sensitive activities like online banking can be dangerous. Public Wi-Fi networks may be unsecured, meaning it’s easier for hackers to intercept and steal your login credentials and bank details. Here’s why:

- Public Wi-Fi networks often lack encryption, meaning hackers can steal any information that’s transmitted to them

- Cybercriminals can set up fake Wi-Fi hotspots and steal all of your data when you connect to them

- Hackers can infect public Wi-Fi and spread malware and spyware to unsuspecting victims

If you absolutely must use public Wi-Fi to do your online banking, a Virtual Private Network (VPN) will help protect you from some of the risks. But there’s still a chance that a cybercriminal will try to hack you, so it’s best to avoid public Wi-Fi if you can. Private, secure Wi-Fi networks are always the safest way for online banking.

What is cybercrime?

Are you wondering, what cybercrime is? These afre crymes committed by scammers, hackers, or fraudsters who commit crimes on the internet. These crimes often include identity theft, financial fraud, and spreading malware through the web.

4. Turn on two-factor authentication

Two-factor authentication (2FA) and multi-factor authentication are powerful tools that help secure your bank accounts. With 2FA enabled, you’ll have to confirm your identity with a one-time code every time you try to log in. This way, even if a scammer knows your password, they won’t be able to sign in.

Most banks offer 2FA, so check your banking app’s settings to see how to turn it on. If you can’t find the setting, contact your bank to find out how to enable it.

Expert tip

You’ll need to set up 2FA for each account individually.

5. Never click on suspicious links

Scammers spread phishing attacks and malware through suspicious links. When you click on a link, it will take you to a malicious site that either steals your personal information or infects your device with malware. Scammers share these links in emails, text messages, or on websites.

To avoid falling victim to a malicious link, don’t click it unless you’re 100% certain it’s safe.

You can check a link by hovering your cursor over it (on a computer) or long-tapping the link (on a smartphone). If the URL looks like a fake website, avoid the link and report the message immediately. For example, it might say it leads to the Apple website, but the URL is something clearly fake, like “www.apple-official.com.”

6. Update online banking on time

If you use your bank’s app to perform online banking, it’s crucial to keep it up-to-date. Software updates often include patches that boost your security and protect against new threats. By updating your app in time, you can ensure that your app is as safe as possible from cyberattackers.

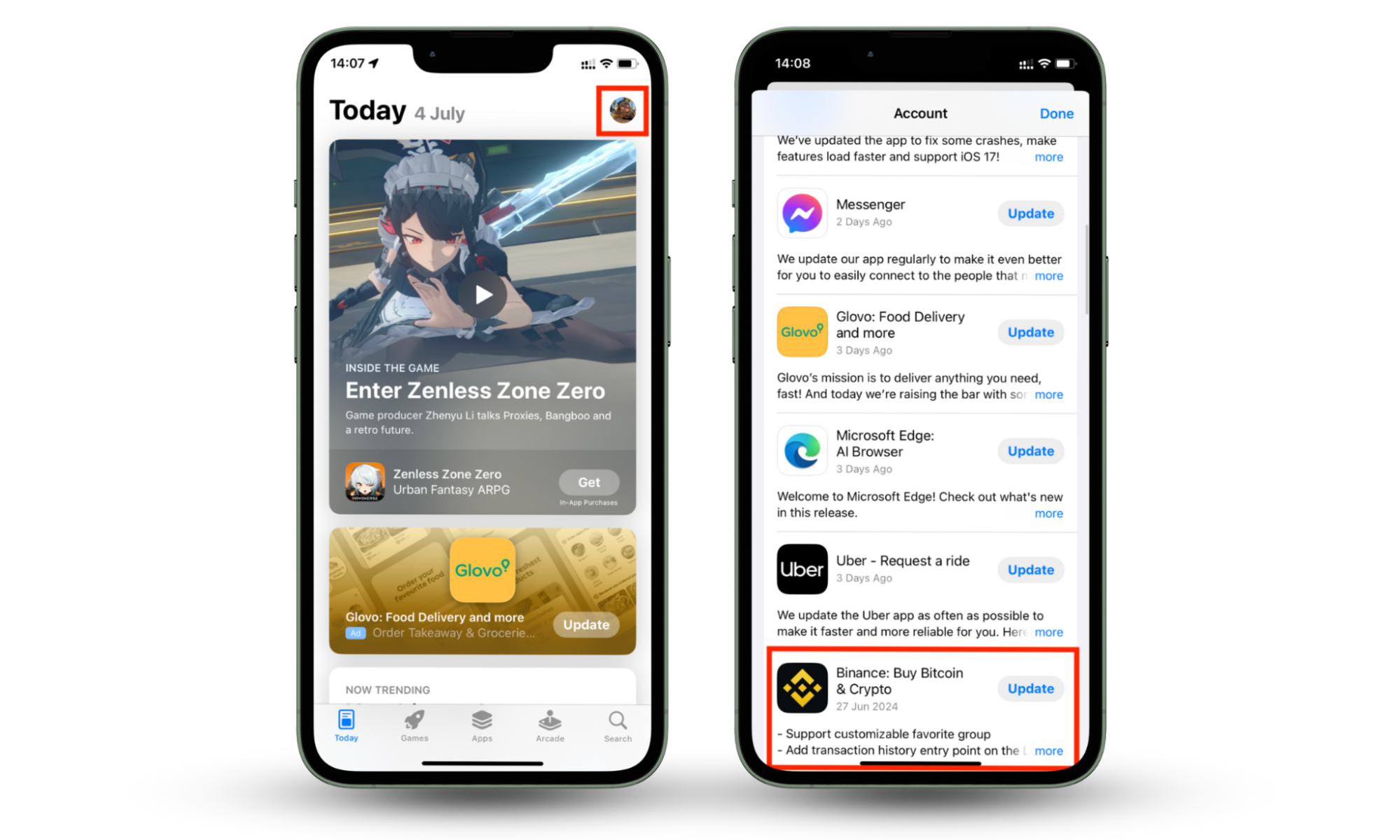

To update your banking app on an iPhone:

- Open the Apple App Store.

- Tap your profile icon in the top-right corner, then scroll down to see if there are pending updates.

- If your banking app needs an update, press Update next to that app.

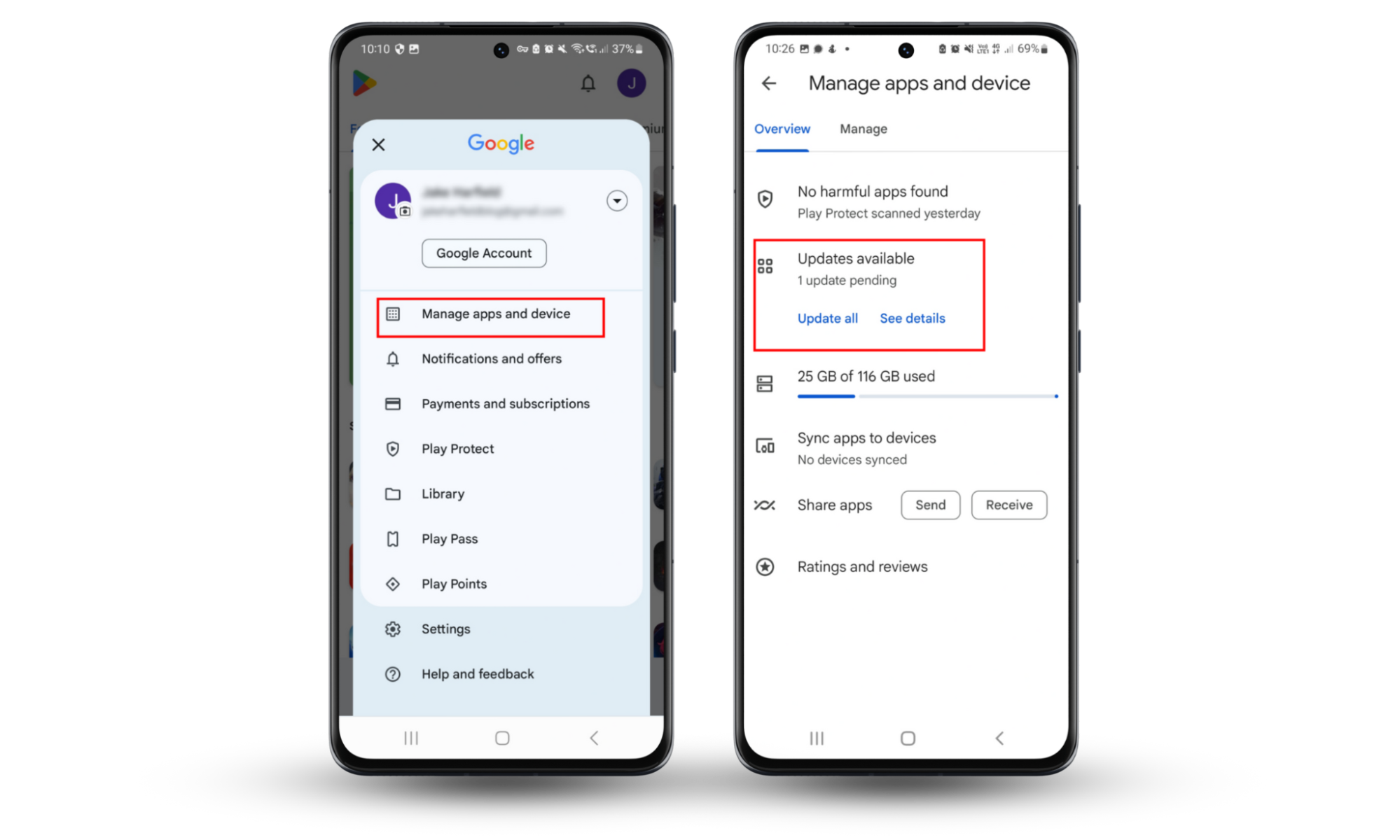

To update your banking app on Android:

- Open the Google Play Store.

- Tap your profile icon in the top-right corner, then select Manage apps and device.

- Under Updates available select Update all. If your banking app needs an update, Google Play Store will apply it now.

7. Enable bank notifications

Many banks let you set up monitoring and alerts for unusual activity. If you sign up for these alerts, the bank will notify you if anything strange happens to your account. You can then act straight away to fix the problem rather than waiting to find out when it’s too late.

You can often set up notifications to monitor your account for large withdrawals or transfers, automated fraud detection, new check orders, and more.

Expert tip

Contact your financial institution to find out what alerts they offer.

8. Use reliable financial applications

To keep your money and identity safe, you should only use private, secure, and reliable banking apps. Reliable financial apps offer robust security measures, data privacy protections, and reliable transaction processing.

To work out if a financial application is reliable or not:

- Check the developer. Most of the time, you’ll use a banking app that your bank itself has developed. By using their app, you can be sure that you have the latest security features and certifications. If you want to use a different app, make sure the developer is a well-known, reputable company—if you’ve never heard of them, steer clear.

- Check the security features. A banking app should have encryption, two-factor authentication, and secure login processes. Reliable apps will state these features in their descriptions or FAQs.

- Research what others have said. Look for app reviews and ratings on official app stores (like Google Play Store and Apple App Store). Check user feedback and independent review sites for expert opinions. If you find anything suspicious, don’t use the app.

9. Check your bank accounts regularly

Regularly checking your bank accounts helps to keep them safe. By keeping an eye on your accounts, you can quickly spot unauthorized transactions and take action to secure them. It also means you can catch and correct errors like mistaken charges.

Here are three tips to help monitor your bank accounts:

- Set a schedule. Choose a time and schedule a reminder to check your accounts once a week. When the time arrives, scan your accounts for unauthorized or strange activity.

- Review your statements. Regularly review your bank statements for signs of fraud or errors. Compare them against your own records to make sure they’re accurate.

- Log out after use. Every time you access or check your bank accounts, make sure to log out—especially on public devices. This will ensure that no one can gain access to your accounts without you knowing.

10. Keep your antivirus software up to date

Antivirus software is one of the most important defenses you can use to protect yourself against digital threats. By keeping it up-to-date, you ensure that it has the latest security measures and can protect you against new viruses, malware, and spyware.

To update your antivirus software, check the app’s settings. If you’re using an Android or iPhone, set your antivirus to update automatically from the Google Play Store or Apple App Store settings menu.

Conclusion

To do online banking safely, you need a combination of strong security measures and good digital hygiene. If you regularly monitor your account, set up alerts, use secure devices, and avoid public Wi-Fi, you should be able to use online banking without falling victim to hackers or scammers.

Stay informed and vigilant to protect your financial accounts from threats. And don’t forget—Clario Anti Spy provides comprehensive protection against spyware and data breaches. Sign up today and protect yourself against prying eyes.