Table of contents

- Is Apple Pay safe and secure for online purchases?

- Complex authentication process

- Tokenization

- Find My iPhone feature

- How you can get scammed through Apple Pay

- Unsecured Wi-Fi

- Phishing

- Apple Pay fraud protection tips

- Does Apple Pay refund money if scammed?

- Does Apple Pay have buyer protection?

- Summary

Is Apple Pay safe and secure for online purchases?

When it comes to safe digital payment methods, Apple Pay security is up there with the best. While you will use your card to pay for items, the original details are not stored on Apple’s servers. As such, it’s tricky for potential hackers to access information that they can maliciously use.

How secure is your Apple Wallet, though? Below are some of the main protective measures that the Silicon Valley giant uses to keep you safe:

- Sophisticated authentication layers

- Tokenization (replacing meaningful data with random character tokens to hide information from hackers)

- Innovative data storage practices

Nevertheless, hackers and other fraudsters make a living finding and then exploiting loopholes in various digital devices and services to steal your funds.

Fortunately, there are ways to improve your iPhone security and privacy settings. But it can be difficult to remember exactly how to do everything, and it’s easy to miss a crucial security feature—and that’s where scammers can get in.

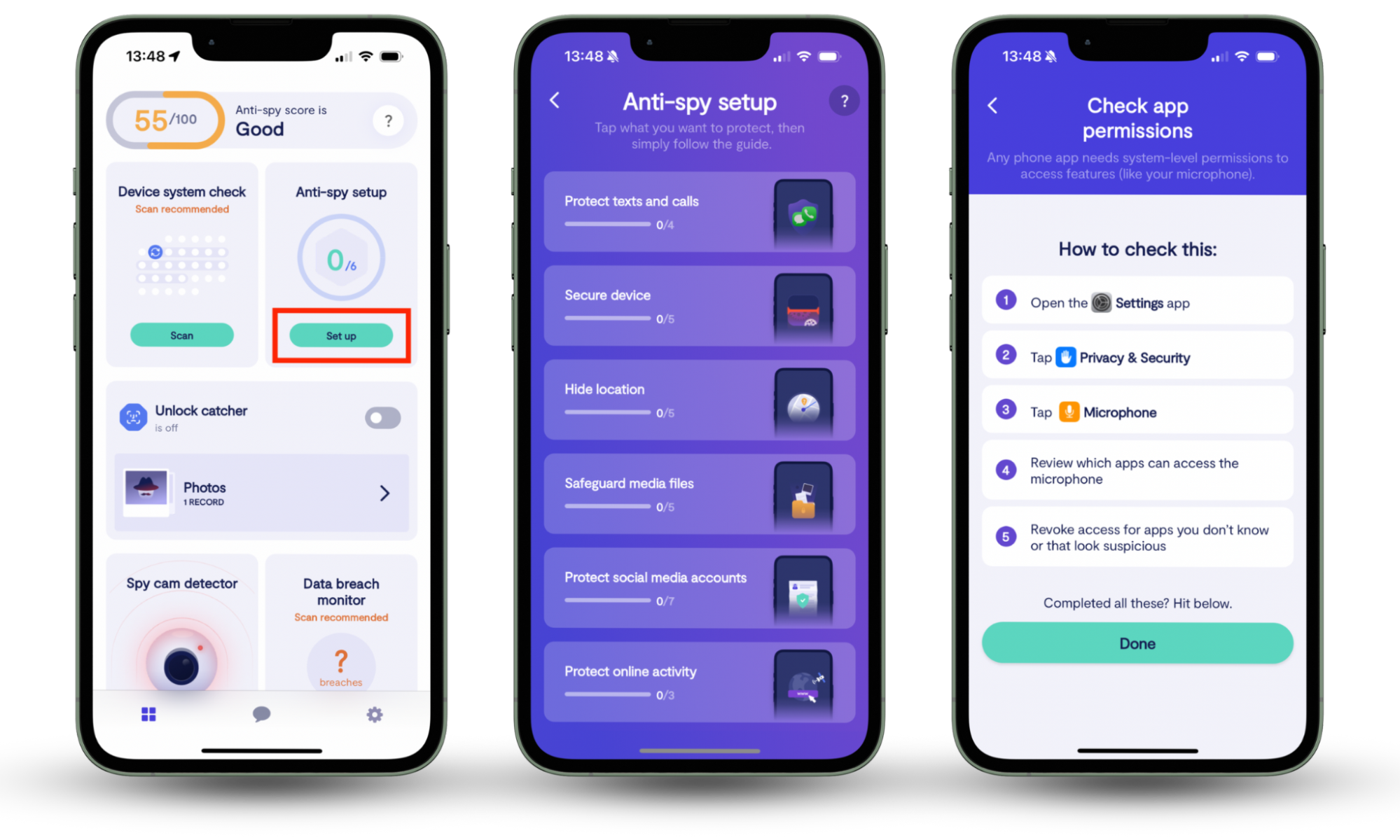

Clario Anti Spy can help you here. Its Anti-spy setup can help you set various privacy and security preferences and safeguard your device from hackers. It won’t just help you with Apple Pay safety—it’ll help you keep your phone virtually undetectable from scammers and stalkers.

How to improve your phone’s security with Clario Anti Spy:

- Download Clario Anti Spy and subscribe.

- Open the app and, under Anti-spy setup, tap Set up.

- In the Anti-spy setup screen, tap each section and follow the on-screen guidance.

- Tap Done when you’re finished.

Now that your device is more secure, making payments online will be less of a risk.

One of the main advantages of Apple Pay is that Apple’s mobile wallet offers credit card protection methods unavailable through most other payment services (unless your device is jailbroken or infected by malware). So, why should you trust Apple Pay?

Complex authentication process

Even if someone steals your iPhone, they won’t be able to purchase anything without going through the passcode or Touch ID/Face ID. Thanks to the encryption used by Apple, not even the secret services or relatives of a deceased owner can unlock the device without the passcode and/or iCloud password.

Tokenization

Apple Pay doesn’t share your credit card number, expiration date, or CVV code with merchants to process payments. Instead, it creates a one-time passcode.

If a fraudster happens to intercept this code, they won’t be able to access your funds. Apple Pay also doesn’t store your credit card information on your device or in its cloud service.

Find My iPhone feature

Is Apple Pay more secure than a physical credit card? Yes, because your card can be stolen alongside your wallet, while Apple Pay is not a physical object, so it cannot be taken from you. Is Apple Pay safer than PayPal? Also yes, thanks to its tight security and encryption of the devices you use it with.

Apple Pay is even safe if you lost your phone or it got stolen as you can suspend your Apple Pay app through the Find My iPhone feature.

How you can get scammed through Apple Pay

Having read this far, you’ll now know a bit about Apple Pay’s advanced security features. But can you get scammed on Apple Pay?

Generally speaking, it is safe to use Apple Pay when purchasing products and making transactions — regardless of whether you do so online or offline. However, you should keep in mind that no system is foolproof. If you’re not careful, you could leave the door open to scammers.

Here are some of the scenarios that could put you at risk of losing your hard-earned money.

Unsecured Wi-Fi

Public Wi-Fi networks are surely a convenient way to enjoy free browsing (especially when you’re abroad and don’t want to pay for data roaming). Still, they are often unsecured or use unsafe passwords like “12345678” or “adminadmin”.

If you happen to add your card information to Apple Pay while using an unsecured Wi-Fi network, a hacker can easily intercept it.

How to stay secure when using public Wi-Fi:

- Avoid changing anything in your Apple Pay profile when you’re away from home

- If you need to make urgent changes, consider using a Virtual Private Network (VPN)

- Keep your usage of public networks to a minimum

Phishing

You may receive fake emails with statements claiming you’ve made a payment or are about to receive some funds as a grant, casino, or lottery win. Worried, you will click the link that should send you to the Apple Pay website for a refund or prize money.

As a result, you will land on a dummy website where you’re asked to confirm your payment information and basically hand your credentials to hackers.

How to protect yourself from phishing? Use common sense. Watch out for “fishy” emails (pun intended) and ignore the ones that:

- Have unprofessional design or suspicious attachments

- Contain sloppy copy, poor grammar, and spelling mistakes

- Have strange-looking links and shady website addresses in them (don’t click such links — only hover your mouse over them to see the URLs)

- Ask you to confirm personal details via email, phone, or text

Expert Tip

If you fall victim to a scam, you’re probably worried about what will happen to your personal details. Are they compromised, and will they be publicly released in a password leak? Don’t worry—Clario Anti Spy’s Data breach monitor can check for you and continue monitoring 24/7. You’ll be alerted the moment your details are found in a database of password leaks or other data breaches.

Apple Pay fraud protection tips

The way you can get scammed with Apple Pay is the same as you could get scammed while using any other payment system. Scammers make you transfer your money via Apple Pay to appear as if it was your own choice.

A cybercriminal will use social engineering to pretend to be your friend or a family member asking for money. They can approach you on social networks and in messengers. Often they would either ask you to pay for something via a dummy online store, send money to a fake charity, or transfer the money to them directly (for example, using Apple Cash).

How to avoid Apple Pay scams:

While you can mitigate the damage if you are scammed, preventing a scam from occurring is the best solution. You can increase your Apple Pay safety when using the feature by following the tips we’ve listed below:

- Never transfer money to unknown websites

- Always double-check payments before completion

- Ask people for more details (something personal only the person they pretend to be can know)

- Block strangers requesting money

What to do if you were scammed via Apple Pay?

Despite your best efforts, it’s always possible that you have a bad day — and a scammer manages to get their way. If you’re unable to prevent a scam from occurring, you can do several things to limit the amount of damage caused. The steps listed below are a good starting point.

- Find the transaction to the scammers in the Wallet & Apple Pay app

- Tap the transaction entry to cancel it

- Contact your bank’s technical support with the scam’s details

- Request your bank cancel the payment

Does Apple Pay refund money if scammed?

Getting a refund from Apple Pay is difficult if scammed, and in many cases, it’s impossible. If you gave a transaction the green light, you cannot get your money back from Apple Pay — even if you found out later that you were scammed.

Does Apple Pay have buyer protection?

When using Apple Pay, it’s important to remember that the service does not have a buyer protection policy. As such, you should consider contacting your bank first in the event of a scam.

If you want to dispute the Apple Pay payment through Apple Support:

- Tap the transaction and select Report an Issue.

- Tap Charge Dispute.

- Select the Reason for Dispute.

- Choose the type of issue that you want to report.

- Start a chat with an Apple specialist.

Summary

Can you get scammed through Apple Pay? In short, yes — it’s possible. But in most instances, you shouldn’t expect to run into too many issues when using the solution for online and offline purchases. Apple has taken several steps to ensure that your information is protected.

But despite its sophisticated data security approach, you still need to apply common sense and remember the best practices surrounding online safety. If you don’t, it doesn’t matter how “safe” the tool you use is; you’ll still put yourself at a significant risk of Apple Pay scams.

Much of Apple Pay’s security depends on your own actions. You can keep your iOS device safe with Clario Anti Spy—the app’s Anti-spy setup can help you improve your phone’s security settings, and, if you do happen to become a victim of a scam, the Data breach monitor can check whether your personal details have been compromised.