Table of contents

- What is Venmo and what is it for?

- Is Venmo safe?

- Types of scams on Venmo

- 1. Quick money scam

- 2. Impersonation

- 3. Payment confirmation scams

- 4. Fake sellers

- 5. Job offer frauds

- 6. Accidental transaction fraud

- 7. Overpayment scam

- 8. Fake support agents

- 9. Phishing

- 10. Fake prize or cash reward

- 11. Romance fraud

- 12. Emergency scams

- 13. Smishing

- 14. Paper check scam

- 15. Onboarding fees

- 16. Rental scam

- What to do if you get scammed on Venmo

- 1. Change the password for your Venmo account

- 2. Contact your bank

- 3. Send a report to Venmo support

- 4. Contact the Business Bureau and the Federal Trade Commission (for businesses)

- How to prevent getting scammed on Venmo

- 1. Make your profile private

- 2. Do not share your personal information with anyone

- 3. Link your credit card to your account

- 4. Manage security and privacy features

- 5. Track the activity of your payment card

- 6. Do not give your phone to strangers

- 7. Do not click on suspicious links

- 8. Send goods only upon receipt of payment

- 9. Don't send money to strangers

- 10. Do not accept payments from unknown senders

- Conclusion

What is Venmo and what is it for?

Venmo is a PayPal-owned payment platform that allows friends and family to send and receive money. With Venmo, convenience is the name of the game. It appeals to people who don’t like to carry cash and prefer to send money using an alternative to their banking apps. It comes in handy when you want to quickly split bills when going to the movies or to grab a bite with loved ones.

According to Business of Apps, Venmo had more than 75 million users in 2022, which is a testament to its popularity. Venmo was founded in 2009 and acquired by PayPal in 2013.

Is Venmo safe?

Venmo offers safety features that make it secure. The payment platform is also safe to use if you know and trust the people you interact with on the service. However, while Venmo offers security features, scammers can create fake accounts to facilitate fraudulent transactions and scam you in other ways, like through phishing.

Types of scams on Venmo

Below are the types of scams you can come across on Venmo:

- Quick money scam

- Impersonation

- Payment confirmation scams

- Fake sellers

- Job offer frauds

- Accidental transaction fraud

- Overpayment scam

- Fake support agents

- Phishing

- Fake prize or cash reward

- Romance fraud

- Emergency scams

- Smishing

- Paper check scam

- Onboarding fees

- Rental scam

1. Quick money scam

Also known as a pyramid scheme, money circle, or cash wheel scam, this scam promises to make victims a lot of money. But first, you must send them a small amount of money via Venmo, which they promise to flip into a larger amount on their behalf and make you a fortune.

For example, a scammer may approach you with the idea of making you $100 if you send them $20 via Venmo. It’s similar to how pyramid schemes work. Sometimes, they pose as one of your contacts to appear legitimate.

2. Impersonation

Have you ever been asked for cash by a Venmo friend but felt something was off? A scammer may have stolen their account. Scammers steal other people’s accounts and impersonate them to solicit funds from their friends. Victims sometimes find out after the fact that they have been scammed. However, it's often too late once you’ve sent scammers the money they requested.

Impersonation scams work similarly to Instagram scams, which entail scammers hijacking an account and asking your friends for money in Direct Messages (DMs).

3. Payment confirmation scams

Payment confirmation scams are popular on online marketplaces like Facebook Marketplace and Craigslist. They entail criminals sending you what looks like confirmation of payment, like an email, except that it’s fake. Alternatively, they may convince you that Venmo won’t release the payment to you until you upload the required shipping information. If the ploy works, you send them the product they “paid” for, essentially getting defrauded.

4. Fake sellers

Unsolicited requests and payments are common on Venmo. When you receive a payment from someone you don’t know, your first instinct may be to return the money. However, it’s advisable not to refund it, as the payment may be from a fraudster or fake seller. Instead, you should contact Venmo immediately or block the user who sent the unsolicited payment. Amazon scams are another example of fake seller scams you can experience while shopping online.

5. Job offer frauds

Job offer scams entail scammers advertising job posts online or in areas where job seekers are likely to see them, like on social media, in internet cafés, or at universities. When you reach out to learn more or send your resume, they ask you for payment to help you secure the job, usually via Zelle or Venmo. But after you pay them, they disappear, often changing their number or not answering your calls and emails.

Did you know?

According to StandOutCV, 12.4 million Americans look for a job every month, and it takes five months on average for job seekers to find a job in the US.

This is why jobseekers are prime targets for fraudsters.

6. Accidental transaction fraud

In an accidental payment scam, fraudsters send you an unsolicited payment and then frantically call you and plead with you to return the money. What you don’t know is that they likely sent you the cash from a fraudulent account or stole the money, and the funds will soon be reversed.

If you return it, you’ll essentially be paying the scammers from your own funds. However, it could be a while before you notice what has transpired. At that point, it would be too late, as the scammer would have probably disappeared without a trace.

7. Overpayment scam

Similar to accidental transaction fraud, an overpayment scam entails a fraudster paying you too much money for an item using a check. They ask you to return the difference via a Venmo payment. The check clears when you deposit it, so your alarm bells don’t go off. However, it will turn out to be stolen, so it will eventually bounce, leaving you with nothing. Instead, the fraudster would have successfully defrauded you of your money.

8. Fake support agents

Fake support agent scams entail fraudsters scamming you by posing as Venmo support agents. They approach you about a supposed unauthorized transaction on your account and pretend they want to assist you. The scammers inform you that they need to send you an authentication code to verify your account, which you must share with them. However, this is all a ploy to have you send them your two-factor authentication (2FA) code so they can access your account.

What is 2FA?

2FA is a security feature that controls access to your data by requiring two forms of authentication before allowing you to access your account or data. Many users prefer to enable 2FA to keep their online accounts safe and protect their data.

9. Phishing

In phishing attacks, scammers reach out to you via text or email, posing as Venmo customer service agents. They ask you to click on a provided link to update your login details or personal information. Clicking on the link takes you to a website belonging to the scammers that resembles Venmo’s login page for unsuspecting customers. When you enter your login details, the scammers can see them and use the information to take over your Venmo account.

Similar to Venmo scams, DocuSign phishing is an example of a phishing scam you should be on the lookout for to protect your data.

10. Fake prize or cash reward

Venmo scammers send you a notification that you’ve won a prize or a cash reward. You’re required to click on a link to provide your personal information or complete a fake survey to claim the prize or cash. When you do, the scammers use those details to access your Venmo account.

11. Romance fraud

Romance scams are done by scammers who defraud unsuspecting victims who are searching for love. The scammers reach out to them using fake social media accounts or profiles on dating apps. They pretend to fall in love with their victims and, soon after, start asking them for money, usually via a payment service like Venmo.

The reasons for asking their victims for money are plenty, including:

- To buy tickets to meet with them (if it’s a long-distance relationship).

- To buy them something special to gift them upon meeting.

- Because they are strapped for cash while awaiting a large payment.

Famous romance scammers

The Tinder Swindler is one such scammer. According to the BBC, convicted international fraudster Hushpuppi also reportedly started as a romance scammer before graduating to money laundering.

12. Emergency scams

This scam occurs when you aren’t careful with your phone. Someone asks to use your phone to make a quick call, only to find your Venmo account and send themselves money from it. This can be done within minutes because sending money on Venmo is quick and easy.

13. Smishing

SMiShing is another form of phishing where scammers pretend to be Venmo support agents who text you about suspicious activity on your account with a link to a malicious website. Sometimes, clicking on the link infects your device with spyware that can monitor you, including your keystrokes, and use that data to obtain your login details for Venmo fraud. It’s one of the most common Venmo spam messages you can come across.

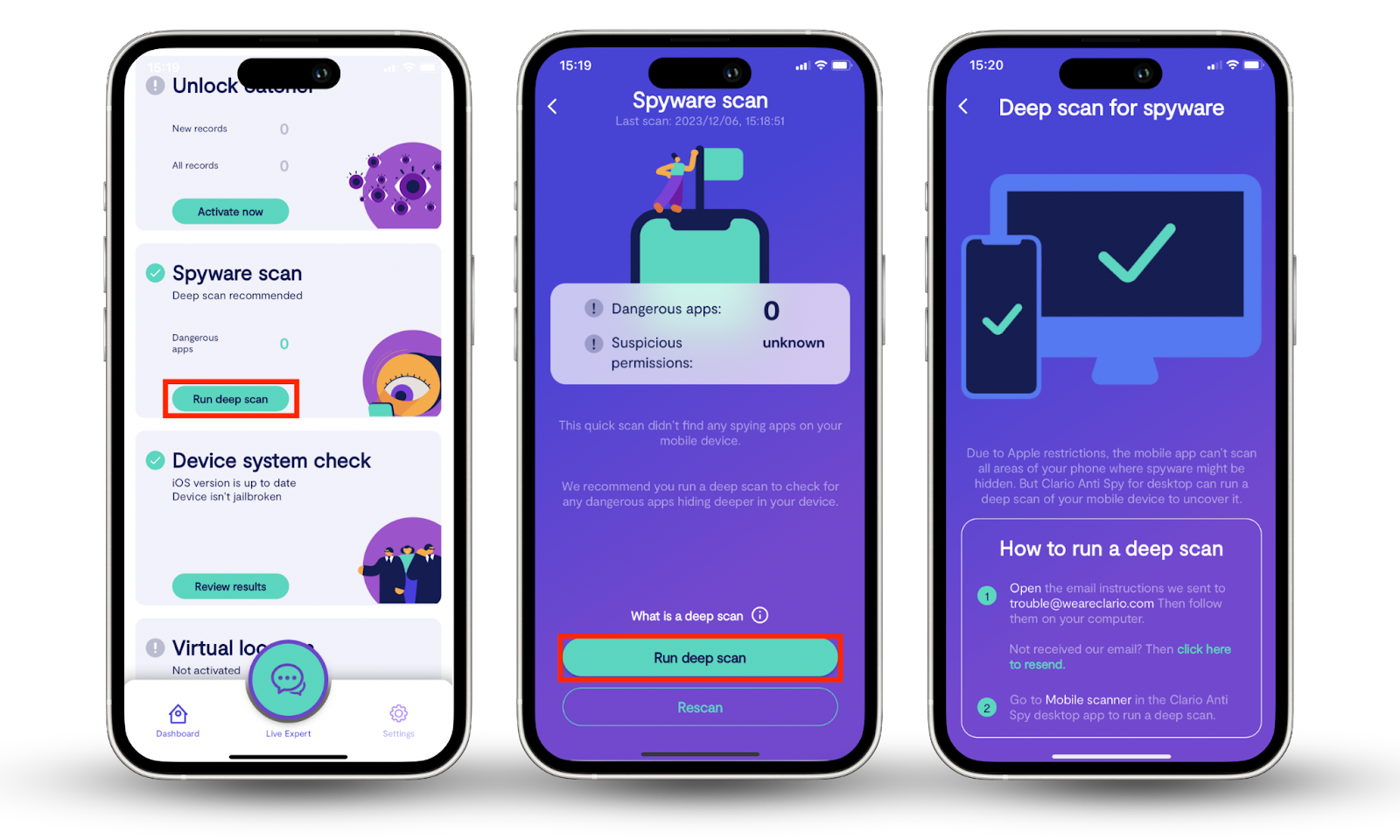

Thankfully, there’s a way to avoid this. Antispy software can help you steer clear of spyware and protect your personal information. Clario AntiSpy’s suite of antispy tools does exactly that. Compatible with iOS and Android devices, the app includes a Spyware scan, Data breach monitor, Anti-spy setup tool, and more. These aid in the prevention, detection, and elimination of spyware.

Here’s how to use Clario’s Spyware scan:

- Download Clario AntiSpy on your smartphone, get a subscription, and set up an account.

- Click Run deep scan and follow the on-screen instructions.

That’s it. Clario will keep its tools enabled for 24/7 protection. If you run into any problems, use the chat function to get expert assistance.

14. Paper check scam

In a paper check scam, the fraudster sends their victim a paper check and then asks them to send the money from their Venmo account. The amount requested is usually smaller than that written on the check, which makes it easier to convince the victim to return it. However, the check bounces after the money is sent to the scammer.

15. Onboarding fees

Onboarding fee fraud is a type of job scam. The scammers post an ad for a fake job and conduct online interviews. They inform the applicant that their application is successful, but they must pay a fee via Venmo to help cover the costs of the onboarding process. This includes getting them a computer and other needed materials in their new role. However, remember that the company should always cover onboarding costs if it is legitimate.

16. Rental scam

A criminal posts a fake property listing online and entices victims by listing the property at a price much lower than the market average. They can also convince them that the demand for that property is so high that they must secure it with a holding deposit before viewing it.

Rental scammers often use stolen images for their listings, including limited property information.

What to do if you get scammed on Venmo

Here’s what to do if you suspect you’ve been a victim of scamming on Venmo:

- Change the password for your Venmo account as soon as possible.

- Contact your bank immediately.

- Send a report to Venmo support.

- Contact the Bureau and Federal Trade Commission (for businesses).

When you’ve been defrauded, time is of the essence. Take the actions below to learn what to do if you've been scammed online through Venmo.

1. Change the password for your Venmo account

Your first response should be to secure your account by changing your password. Ensure you use a strong password, ideally one you don’t already use for other online accounts, to prevent future hacking attempts and subsequent losses.

2. Contact your bank

Notify your bank of the fraudulent activity. Sometimes, the bank can help you get back the money you’ve been defrauded of. Regardless, it should be able to freeze the cards linked to your Venmo account and set up alerts for future suspicious activity.

3. Send a report to Venmo support

Gather the evidence you have of the suspected fraudulent activity and use the relevant Venmo channel to report it:

- To report Venmo phishing emails, send a report to phishing@venmo.com.

- To report phishing text messages or suspected fraudulent phone calls, contact the Venmo Support team and complete the form provided.

4. Contact the Business Bureau and the Federal Trade Commission (for businesses)

In addition to reporting suspected fraud to Venmo, you can contact the Business Bureau and the Federal Trade Commission (FTC) for assistance. Note that there are separate avenues for reporting fraud and reporting identity theft with the FTC—choose the appropriate option.

How to prevent getting scammed on Venmo

Here’s how to avoid Venmo scams:

- Make your profile private.

- Do not share your personal information.

- Link your credit card to your account.

- Manage security and privacy features.

- Track your payment card’s activity.

- Do not give your phone to strangers.

- Do not click on suspicious links.

- Send goods after receiving payment.

- Don't send money to strangers.

- Do not accept payments from unknown senders.

1. Make your profile private

Venmo sets your transaction activity to public by default. Consider going private or setting your profile to only be accessible to your friends to avoid attracting the attention of fraudsters.

2. Do not share your personal information with anyone

Believe it or not, scammers can use your personal information to guess your Venmo passwords. To reduce the risk of getting scammed, avoid sharing your personal information with other people or online.

3. Link your credit card to your account

It’s safer to use a credit card on Venmo than it is to use a debit card. This is because it’s easier to file a chargeback or cancel a charge with a credit card, which is helpful when you’ve been defrauded.

4. Manage security and privacy features

Take advantage of Venmo’s security and privacy features and those installed on your device. These include:

- 2FA

- Biometric access

- Antivirus software

5. Track the activity of your payment card

It’s advisable to constantly check your bank statements for irregularities and unknown charges. This will help you identify and act on suspicious transactions promptly.

6. Do not give your phone to strangers

There are multiple reasons why you shouldn’t let strangers use your phone, and protecting your Venmo account is one of the top reasons. If someone needs to place a call on your phone urgently, dial the number for them and have them make the call in your presence while you wait.

7. Do not click on suspicious links

No matter how legitimate an email or text message from Venmo may seem, never click on any links in it. If you think it may be real, contact Venmo directly to verify it before taking any action.

8. Send goods only upon receipt of payment

Fraudsters can manipulate or forge proof of payment. To avoid getting scammed, always wait until a customer’s payment has reached your Venmo account before sending out items.

9. Don't send money to strangers

Only send money to people you know and trust. If you’re buying items, ensure you’re paying legitimate sellers or business profiles that won’t defraud you.

10. Do not accept payments from unknown senders

Scammers can trap you by sending you fake Venmo payments so you can “return” them and subsequently lose money. That’s why it’s best not to accept payments from people you don’t know or recognize. Instead, wait for Venmo to reverse the payment on your behalf.

Conclusion

There are tons of Venmo scams out there, and you can fall victim to them or other types of online scams at any time. Use the tips in our article to protect your funds and avoid getting scammed through Venmo. Follow safe internet practices to avoid being singled out for scams.

More importantly, use the various Clario AntiSpy tools available on the app to help protect yourself from spying, which can lead you to becoming a Venmo scam victim.