Table of contents

- How to check if your identity has been stolen

- What to do if you are a victim of identity theft

- Get in touch with the companies and banks affected by the theft

- Place a fraud alert on your credit reports

- Freeze your credit

- File an identity theft report with the Federal Trade Commission

- Report identity theft to local law enforcement

- Ask for copies of your credit reports and review them

- Request to block damaging information in your credit report

- Work with businesses to remove bogus charges and stop reports

- Close accounts opened by fraudsters

- Initiate procedures for re-issuing your IDs

- How to report identity theft to your local police office

- How to recover from identity theft

- How Clario protects your identity

- Clario Anti Spy’s Data brech monitor

How to check if your identity has been stolen

Here are several signs that may serve as warning signs of identity theft:

- You notice withdrawals from your bank that you didn’t make yourself.

- Payments you can’t explain show up in your billing statement.

- Your billing statements or other mails go missing.

- Merchants refuse your checks.

- Debt collectors call you about unexplained debts.

- Medical providers bill you for services you do not remember using.

- Your health plan tells you that you’ve reached your benefits limit even if you haven’t used it.

- Your medical records are showing conditions you don’t have.

- The tax bureau notifies you that more than one tax return was filed in your name.

- The tax bureau notifies you that you have an income for another employer.

- And the most obvious one… You’re given notice by your company or bank that your information was breached.

If you experience any of the above, you can double-check with the relevant consumer reporting agencies to place “fraud alerts” in your file under the Fair Credit Reporting Act.

The Fair Credit Reporting Act is federal legislation meant to promote fair, accurate, and private background checks and other consumer reports. Under this legislation, you also have the right to free copies of the information in your file. You also have the right to obtain documents related to the fraudulent transactions made or accounts opened using your personal information.

What to do if you are a victim of identity theft

Take action as soon as you notice any signs of identity (ID) theft. The quicker you respond, the better your chances of minimizing damage and restoring your financial reputation.

Don’t worry—sooner or later, you’ll get to the bottom of this, and things will be back to normal. In the meantime, you need to know your rights and your options, as well as the government and commercial agencies which can help you.

Before we dive into post-breach solutions, we thought we’d remind you about the importance of preventing identity theft. After all, identity theft can cost you money, time, your reputation, and much more. Clario Anti Spy’s Data breach monitor can help. By keeping a lookout for data leaks containing your email address, our Data breach monitor ensures that you can proactively secure all your online accounts before someone steals your identity when your email is compromised.

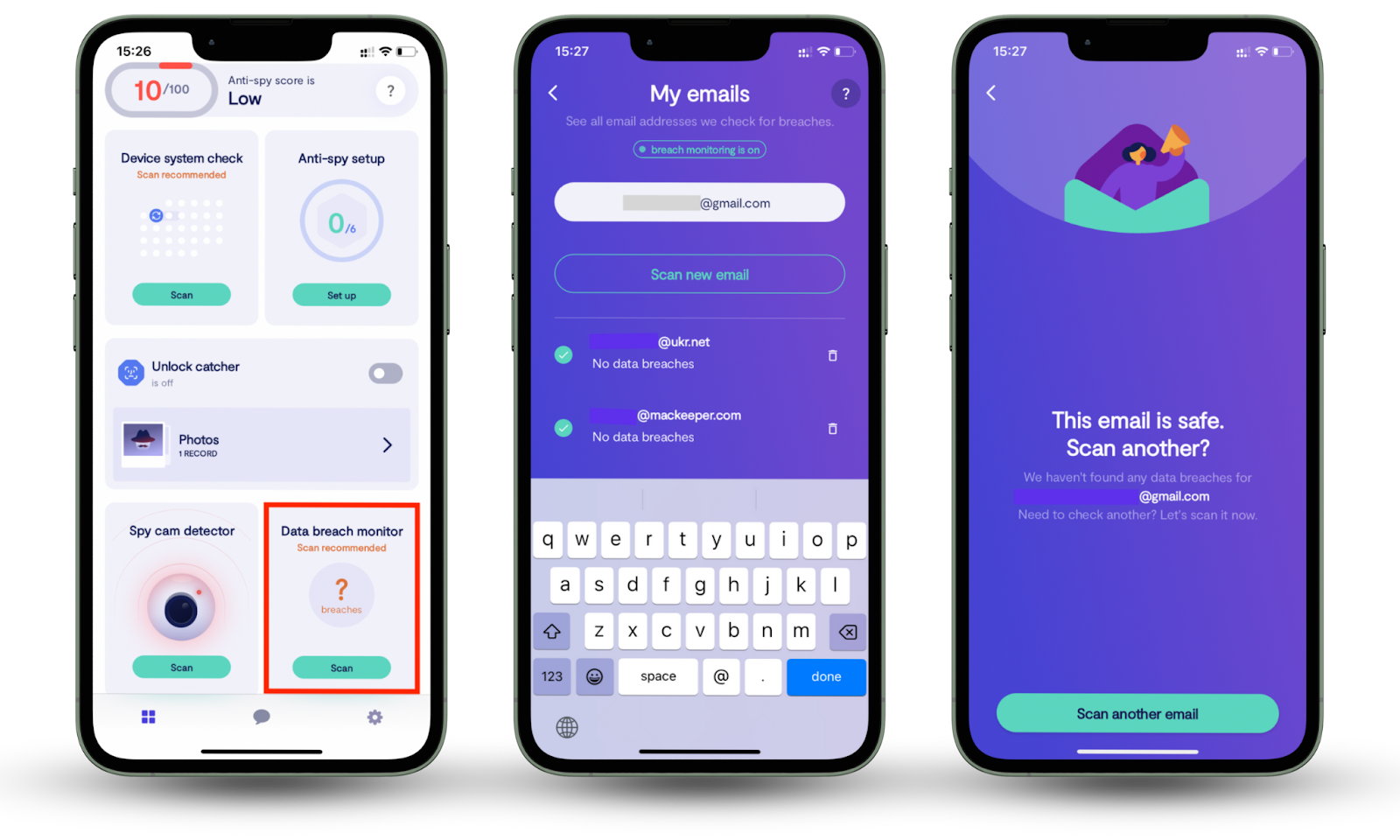

Secure your email address with Clario Anti Spy’s Data breach monitor. Here’s how:

- Download Clario Anti Spy on your mobile or desktop device, get a subscription, and set up an account.

- Open the app and select Scan in the Data breach monitor section. This will open a new window.

- Tap the Check for breaches button at the bottom of the screen. Clario Anti Spy will immediately get to work finding data leaks containing your email address and share what it unearths. If your email was leaked, follow Clario Anti Spy’s instructions to secure it. If not, no further action is required.

- At this point, you can choose to Scan another email and repeat the process or leave it to Clario Anti Spy to continuously monitor the email address you provided.

Now, let’s explore the steps you can take when your identity has been stolen.

Get in touch with the companies and banks affected by the theft

Alert your bank about the ID theft immediately so you can get assistance blocking your card and recording any bogus transactions you didn’t make. Pick up the phone and call the fraud department of the corresponding businesses. Having details of a registered complaint will be an advantage when you file for the removal of those fraudulent charges from your bank balance.

Place a fraud alert on your credit reports

There are three major CRAs (Credit Reporting Agencies) in the US. However, in this case, you only need to inform one as they are legally obliged to exchange information.

Once you place a free one-year fraud alert with Experian, TransUnion, or Equifax (you can later extend it to seven years), any bank or business will be required to verify your identity before issuing new cards or opening a line of credit. Make sure you receive confirmation letters from all three bureaus.

Freeze your credit

You can restrict access to your credit information to prevent criminals from opening new accounts in your name. For that, order a security freeze from all three CRAs (you’ll have to file applications for each).

Here’s how it works: if someone wants to gain access to credit funds under your name, the lender won’t approve the request without checking your credit history or scores. Since this can’t be done without your express consent, the entire scheme will crumble like a house of cards.

File an identity theft report with the Federal Trade Commission

This step is absolutely crucial when dealing with instances of identity theft. First and foremost, your FTC report serves as legal proof to any businesses your unfortunate incident might have affected.

Secondly, if the criminals used your ID to exploit your social benefits (like claiming an economic impact or unemployment payment), FTC offers tools to report that as well. You can also declare tax-related fraud to the IRS here (for instance, if someone used your Social Security Number (SSN) to file for a tax refund).

Visit IdentityTheft.gov to fill out a very comprehensive and easy-to-use web form and get a personal recovery plan. Alternatively, you can call 877-438-4338.

Report identity theft to local law enforcement

This is another step we definitely recommend you take. We’ll look at this more later, but keep in mind these two points for now:

- It will help you with further legal proceedings.

- You should only do this after filing your FTC report.

Ask for copies of your credit reports and review them

It’s a good idea to request your credit reports from each of the three CRAs independently, compare them, and identify any suspicious activity. This will ensure you haven’t missed any irregularities and have a full account of the events.

Request to block damaging information in your credit report

As a victim of identity theft, you qualify for the removal of information and records pertaining to the fraudulent activity from your credit report. This includes unpaid purchases, late loan charges, etc. Your credit reputation won’t be tarnished, so hopefully allowing for a much brighter financial future.

Work with businesses to remove bogus charges and stop reports

No one should hold you responsible for another person’s criminal activity. Armed with your FTC report, contact the businesses that sustained damage from your impersonators’ actions and request that they:

- Remove the resulting charges from your account.

- Stop reporting this activity to the CRAs as related to your person.

And remember — it’s always best to have confirmation of the removal of any charges in writing.

Close accounts opened by fraudsters

Make a list of all the fraudulent accounts criminals have opened in your name, then go through it - make calls, send proof and close these accounts one by one. It’s time to wipe the slate clean.

Initiate procedures for re-issuing your IDs

If not only your credit cards and personal data but also your IDs were compromised, you might have to go through the tedious process of receiving new identification documents. Contact your Department of Motor Vehicles, Social Security office, or local government authority to issue a new driver’s license, SSN, passport, or ID card.

Depending on your specific situation, you may need to take additional steps, such as:

- Clear your criminal record, if an impostor used your credentials during an arrest.

- Contact a debt collector in case they keep harassing you about the fraudster’s debts.

- Update your medical history, if the criminal used medical services under your name.

But we’d like to go back to the one item you shouldn’t overlook and give some essential advice on filing an identity theft report with the local law enforcement.

How to report identity theft to your local police office

It’s very likely that you won’t be legally obliged to inform the local police of the identity theft, and your FTC report will have you covered. However, you should contact the police department if:

- An entity affected by the identity theft requires a police report

- You know who the perpetrator is

- There’s a record of an interaction with the criminal using your stolen identity

If you do need to file a police report, here’s what we recommend you do:

- Prepare your FTC ID Theft Affidavit and your photo ID.

- Gather as much evidence of identity theft as you can: proof of fraudulent accounts, transactions, purchases, or loans—in electronic or physical form.

- Contact your local police department, state the details of your issue clearly, and ask for specific instructions.

Police officers may ask you to fill out an online application or report form or come down to the office. Regardless of the investigation’s success, the existence of a police report may prove very beneficial when resolving disputes and filing claims later.

For a more detailed guide, read our article dedicated to this topic. Meanwhile, there’s one last question we would like to address.

How to recover from identity theft

On average, the identity theft matter should be resolved in about six months, provided you dedicate enough of your time to it. Pay attention to the list below, these are the actions you will have to do in order to recover from identity theft.

- Close new accounts opened in your name. Cut off the thief’s access. Ask the agencies to notify you if ever the thief tries to access them.

- Remove bogus charges from your accounts and correct your credit report. After you’ve contacted the credit bureaus, you can request for the fraudulent information to be removed. You can use a sample request template by the FTC and submit it along with your identity theft report and other information to prove your claim.

- Consider adding an extended fraud alert or credit freeze. If you still don’t feel safe about your accounts, consider extending your credit freeze but only if you can afford it.

- Stop debt collectors from trying to collect debts you don't owe. If you’ve filed the report and dispute, this shouldn’t be a problem. However, if the debt collectors are insisting you should still pay for the expenses, consider hiring a lawyer to help you fix this problem.

- Replace government-issued IDs. Replace compromised IDs and cards so that the government agency connected to them gets flagged if the thief continues using the old one.

- Replace passwords. For all compromised accounts, replace your passwords ASAP and implement two-factor authentication, if possible.

- Clear your name of criminal charges. If you were a victim of criminal identity theft, then you must clear your name by submitting the police report and identity theft report to local authorities.

- Remain vigilant. Your experience may teach you to be more vigilant in the future but you can never be too careful. Free your mind of worries by using a security product that protects you and your identity like Clario Anti Spy.

How Clario protects your identity

Even though the government might have a plan for protecting people who have fallen victim to identity theft, it's best to prevent it from happening to you in the first place.

Clario Anti Spy’s Data brech monitor

Check your emails for breaches in real time to prevent any of your sensitive information from being stolen. Clario Anti Spy will notify you in case someone compromises your security and leaks your email address in a known data dump.

No one is 100% safe from ID theft, but we can at least try to be more careful. Just imagine how much time and stress we could save ourselves by learning to prevent identity theft from taking place in the first place instead of dealing with its consequences.

Use our expert guides in this article to take back control of your sensitive information and identity. In addition, prioritize using a data breach monitor, like the one from Clario Anti Spy, to get instant notifications when your email address has been leaked. This will enable you to quickly step in and prevent a case of identity theft.