Table of contents

- What is account takeover?

- How does account takeover work?

- How сommon is account takeover?

- What is identity theft?

- How does identity theft work?

- How common is identity theft?

- Difference between account takeover and identity theft

- How to protect yourself against account takeover and identity theft

- Preventing account takeover

- Protecting yourself against identity theft

- 4 steps to take if you are a victim

- Conclusion

What is account takeover?

Account takeover happens when hackers break into your existing online accounts. They either steal your username and password, trick you into sharing your password, or brute force your login details.

Hackers usually go after your email account because they’re like master keys. If someone controls your email, they can get into almost everything else—including banking accounts and government services.

Likewise, your social media accounts contain lots of details about you they can use to trick other people or spread viruses. Once they have access, they can impersonate you and ask your contacts to send them money or open malicious links.

However, they may also go straight for your banking and shopping accounts. With these, they can transfer funds to themselves, apply for loans, or buy expensive items on sites like Amazon.

How does account takeover work?

Account takeover usually happens in three main ways:

- Stolen passwords from data breaches are the most common method. When someone hacks a company, they leak usernames and passwords online. Criminals buy these and try your stolen password on different websites.

- Social engineering tactics (like phishing attacks) performed to trick you into giving away your login details. You might get a fake email that asks you to "verify your account." When you click the link and type in your password, hackers capture it.

- Brute force attacks involve criminals using computer programs to guess your password. They start with common passwords like "123456" or "password" and work their way through combinations until they find the right one.

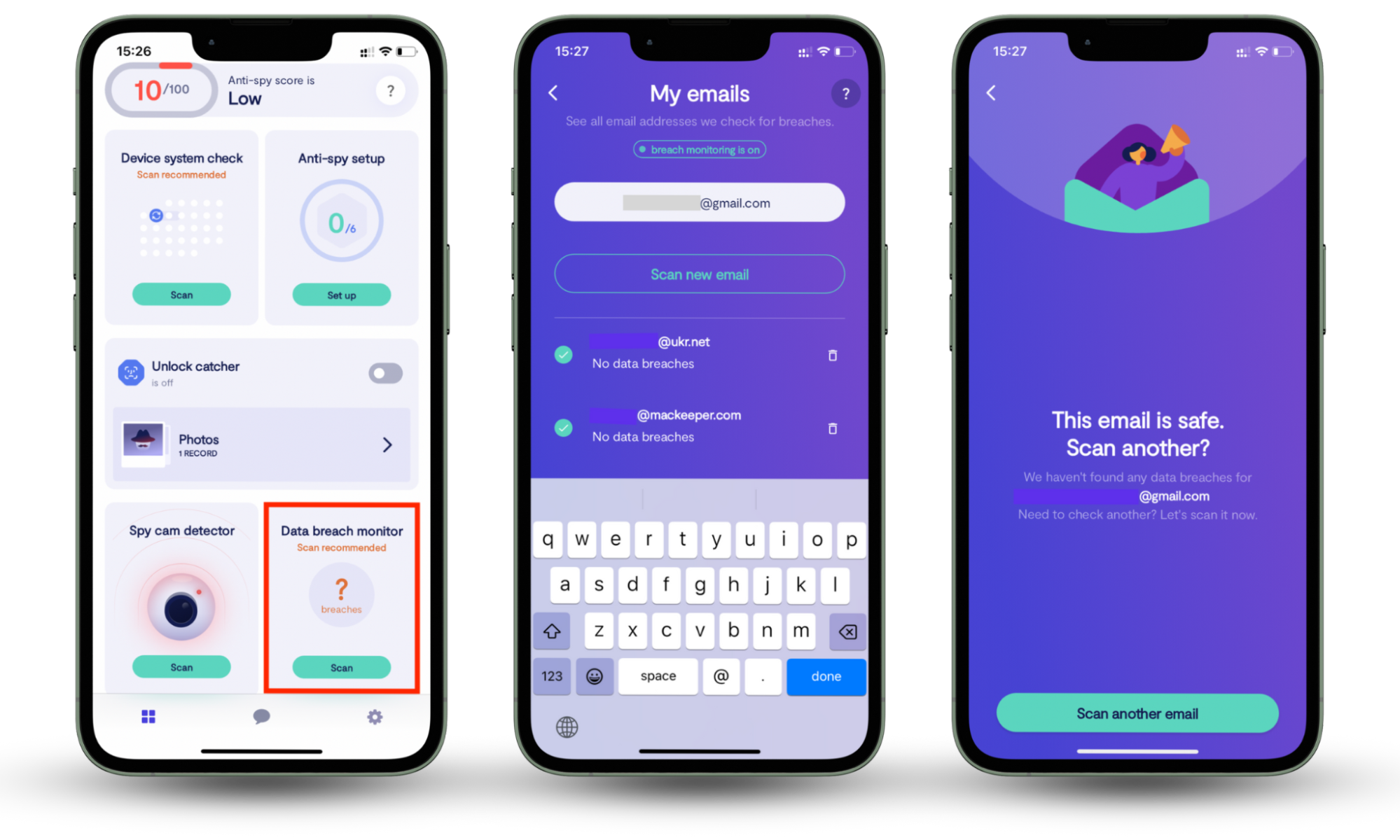

To see if your information is for sale on the internet, use Clario Anti Spy’s Data breach monitor:

- Download Clario Anti Spy and create a secure account.

- Log in, then find the Data breach monitor option.

- Press Scan and enter your email address to start. Clario Anti Spy will inform you if someone has targeted you in any data breaches.

How сommon is account takeover?

According to Security.org, account takeover affected 29% of online users in 2023, increasing from 22% in 2022. If this trend continues, account takeover fraud will affect 36% of users in 2025. It mostly affects individuals, but business employees are also common targets.

Even worse, artificial intelligence (AI) bots are making this harder to defend against. Scammers can quickly generate phishing emails and deepfake videos to trick you, and they can even bypass CAPTCHAs that websites use to prevent automated login attempts.

What is identity theft?

Identity theft is when criminals steal your personal information to pretend to be you. They collect details like your full name, Social Security number, address, date of birth, and other identifying information to impersonate you for fraudulent purposes.

The different types of identity theft include:

- Financial: Criminals open new bank accounts, credit cards, or loans using your personal information. An example of this is if your credit card CVV has been leaked.

- Medical: Someone uses your health insurance to get medical treatment, messing up your medical records.

- Criminal: A criminal gives your name and information when arrested, leading you to take on their criminal record.

- Tax: Someone files tax returns using your Social Security number to steal your tax refund.

How does identity theft work?

Like with account takeover, identity thieves try to gather your personal information through data breaches, physically stealing your documents or by social engineering.

The process can take weeks or months as criminals gradually build a complete picture of your identity before striking. Once thieves have enough information, they begin impersonating you.

They might target banks and credit unions seeking to open new accounts or drain your funds. They could also target mobile carriers to gain access to other accounts or hospitals to commit medical fraud.

Even worse, with your full identity, scammers might impersonate you with government agencies. They could apply for benefits, tax refunds, or ID replacements to continue their scams.

How common is identity theft?

According to the Federal Trade Commission (FTC), it received over 1.1 million reports of identity theft in 2024 (in the U.S. alone). The financial impact of these crimes amounted to over $12.5 billion dollars—an increase of 25% over the last year.

Difference between account takeover and identity theft

Both crimes involve stealing your information but differ in what they target, how quickly they work, and how you deal with them. Here’s a closer look at the difference:

- Target: Account takeover hijacks accounts you already own, while identity theft creates new accounts in your name.

- Duration: ATO happens instantly once criminals have login credentials, but identity theft takes time to establish new accounts.

- Detection: You'll quickly notice when locked out of hijacked accounts, but identity theft often goes undetected for months until unexpected bills arrive.

- Resolution: Recovering compromised accounts typically takes days or weeks, while fixing identity theft damage can take years and involves disputing fraudulent accounts, correcting credit reports, and potentially clearing criminal records.

- Impact scope: ATO affects specific solutions you use, while identity theft can damage your overall financial standing, credit score, and legal record across multiple areas of your life.

How to protect yourself against account takeover and identity theft

While they’re distinct threats, preventing ATO and identity theft often overlaps with cybersecurity best practices. However, there are also unique steps crucial for defending against each risk. Here’s what to do.

Preventing account takeover

To safeguard your online accounts from unauthorized access, implement these essential measures:

- Enable two-factor authentication (2FA). Even if criminals steal your password, they'll need access to your phone or authentication app to get in.

- Set strong, unique passwords. Create complex passwords and store them securely so you don't need to remember dozens of different combinations.

- Monitor login alerts. Most services send emails or texts when someone logs in from a new device. If you receive unexpected alerts, change your password immediately.

- Never reuse passwords. When a criminal breaches one account, they’ll try that same password on your banking, shopping, and social media platforms.

Protecting yourself against identity theft

To minimize the risk of your personal identity being stolen and misused, prioritize these critical steps:

- Freeze your credit with all three major bureaus (Experian, Equifax, TransUnion). This prevents anyone from opening new accounts in your name, even if they have your Social Security number.

- Monitor your credit reports regularly. You can check all three reports for unfamiliar accounts or inquiries free annually at AnnualCreditReport.com.

- Shred sensitive documents before throwing them away. Bank statements, tax documents, and pre-approved credit offers contain information identity thieves need.

- Use secure networks for online activities. Avoid public Wi-Fi for banking or shopping, as criminals can intercept your data on unsecured connections. Just using incognito mode isn’t enough—find out what incognito mode is to learn why.

- Limit sharing personal information on social media. Details like your full birthdate, preferences, or mother's maiden name help criminals answer security questions or build your identity profile. To clear your data, learn how to remove my personal information from the internet.

4 steps to take if you are a victim

If you experience either crime, it’s crucial to act immediately. The quicker you respond, the better your chances of limiting damage. Here’s what to do:

- Change passwords: Change all affected passwords using unique combinations.

- Notify institutions: Contact your bank, credit card companies, and any online services where fraud occurred.

- Report to authorities: File a report with the FTC at IdentityTheft.gov (for identity theft) and local law enforcement. They’ll offer you resources, services, and advice.

- Place fraud alerts: Contact one of the three major credit bureaus to place a fraud alert on your credit file. The bureau you contact will notify the other two.

Conclusion

Protecting your digital life requires vigilance. Use strong passwords, 2FA, and smart data habits to build your defenses. Staying proactive is your best protection against new threats in account takeover and identity theft. To prevent scammers from gaining access to your accounts and stealing your identity, keep an eye on your passwords and personal information with Clario Anti Spy’s Data breach monitor.