Table of contents

- What are internet scams?

- 12 common internet scams and examples

- 1. Phishing scams

- 2. Pharming scams

- 3. Topical scams

- 4. Tech support scams

- 5. Mandate fraud

- 6. Scareware

- 7. 419 scam or advance fee scam

- 8. Grandparent scams

- 9. Personal loan scams

- 10. Lottery scams

- 11. Debt relief and credit repair scams

- 12. Money transfer/check scams

- How to avoid online scams

- What to do if you fall victim to an online scam

What are internet scams?

As the name suggests, internet scams are a type of fraud or crime committed using the internet. Typical examples of internet scams include identity theft, phishing, and pharming. Using online platforms or malicious software, attackers will usually attempt to steal sensitive data or bank account information.

Many internet scams will use some kind of social engineering. Essentially, that means using psychological manipulation to trick people into giving up their valuable personal data.

12 common internet scams and examples

There are many different kinds of online scams, but here are some of the most common ones, with real-life examples. Being aware of these scams will help you to avoid them yourself.

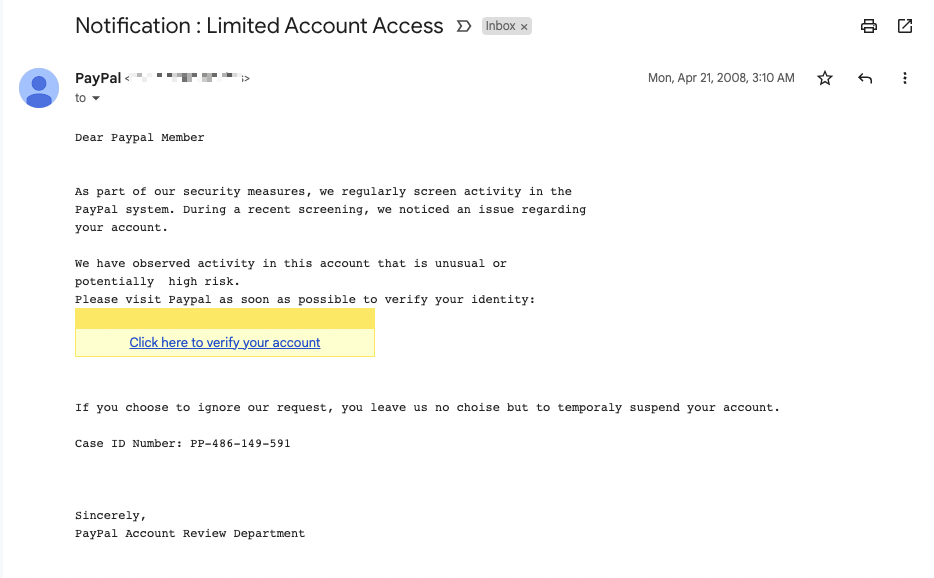

1. Phishing scams

Phishing is a form of scam in which the victim is duped into thinking they’ve received an email or text message from a legitimate organization, such as a bank, university, or internet provider.

The objective of phishing is to trick the user into handing over their personal information. This can include their full name, date of birth, and credit card numbers. Usually, they’ll be directed to enter this on a fake website.

This is how to recognize and avoid phishing scams:

- Bad spelling and grammar. Unlike legitimate organizations, criminal gangs don’t tend to employ spell checkers.

- An offer of a prize or a refund. These are designed to entice you into opening the email and clicking the links.

- A request to confirm your personal information. Legitimate organizations won’t ask for sensitive information like PINs and passwords.

- Requests to update billing information. If a business needs you to update your billing details, you’ll be able to check this when you’re logged into your account with them.

2. Pharming scams

Pharming is similar to phishing, as it also involves sending victims to fake websites to steal information. The key difference is the victim is redirected from the real website to the fake one. Typically, this begins with sending victims emails with malicious code, which installs malware on your computer. This then modifies an important file on the machine, which controls web browser’s behavior, diverting traffic to a fake website instead of the real one.

Signs of a pharming scam include:

- A link to an unsecure website. Look for the padlock icon in your browser. If it’s not there, it means the website you’re on doesn’t have a valid security certificate. That’s a pretty good sign it’s a fake.

- Suspicious activity on your accounts, like changed passwords and credit card charges you didn’t make.

3. Topical scams

Cybercriminals often use current events to entice people or panic them. Right after a natural disaster, for example, they might set up a fake fundraiser to steal money from people.

At the height of the coronavirus pandemic, scammers sent out emails about testing kits and lockdown fines — none of which were real.

And they’ll use public holidays like Christmas to encourage people to open spam emails and click links.

How to spot a topical scam:

- If you’re offered any deals that seem too good to be true, they probably aren’t true.

- Don’t give to any fundraisers unless you’re 100% sure who’s behind them and where the money is going.

- Be extra vigilant about any topical communications you get.

4. Tech support scams

In a tech support scam, a consumer receives an email or phone call telling them their device has a virus or malware. They’re told they need to download special software or let a repair specialist control their PC to fix it. In reality, this is an attempt to infect the victim’s device with malware, track their activity, and steal their personal information.

Signs of a tech support scam:

- Unplanned calls or emails from technical support people.

- Pushy support people, who ask to take control of your computer.

- Support calls for a device or software you don’t own.

5. Mandate fraud

In mandate fraud, the victim is deceived into updating bank account information. Imagine being a loyal subscriber to a company and receiving a call from someone pretending to work there, asking you to update your billing information. You don't get your package next month, so you call, but they say you haven't paid your membership fee. That’s when you know you’ve fallen victim to mandate fraud.

Here’s how you spot this scam:

- A company representative tries to get your personal information via a call or email.

- A company you work with suddenly changes its banking details.

- You speak to someone you’ve never heard of, or they have new contact details.

- You get an invoice for something early or for something you weren’t expecting.

- The person seems in a rush to get you to pay.

6. Scareware

Scareware frightens victims into visiting a website or downloading software. You’ll be told your computer is infected with a virus, is being spied on by criminals or something similarly scary. You’ll then be prompted to install software or visit a website to fix the problem.

But this will either be an attempt to make you install malware or will lead to a phishing site.

Here are ways to identify these scams:

- A pop-up demands immediate attention, using language that seems overly dramatic or frightening.

- The website claims to have scanned your device, even though you haven’t installed anything.

7. 419 scam or advance fee scam

The 419 scam is a specific type of advance fee fraud focusing on email, phone, and social media platforms. The strategy is to promise a big financial reward if you pay a fee beforehand.

Of course, that reward doesn’t exist, and the scammer simply runs away with your money.

Here’s how to spot a 419 scam:

- You’re offered something that seems too good to be true.

- You’re asked to pay an upfront fee to get your reward.

- Someone asked you for help getting large sums of money out of a foreign country.

8. Grandparent scams

Some online scams target grandparents with a prior investigation into their grandchildren's social media or by buying information from cybercriminals.

The caller gives just enough info to trap the grandparents. The goal is usually to get money or personal information from them.

Here are some tips on how to recognize grandparent scams:

- The scammer requests urgent payment.

- They call late at night — likely to disorient the victim and feel like the situation is an emergency.

- The call comes from a number you don’t recognize.

9. Personal loan scams

There are many different types of personal loan scams. Some fraudsters charge a fee upfront and then disappear, while others simply hide the true cost of the loan. Their goal is to get your personal information or money and disappear.

These are signs of a personal loan scam:

- The fraudster doesn't care or doesn’t even ask about your credit history.

- They offer loans over the phone.

- The rate seems too good to be true.

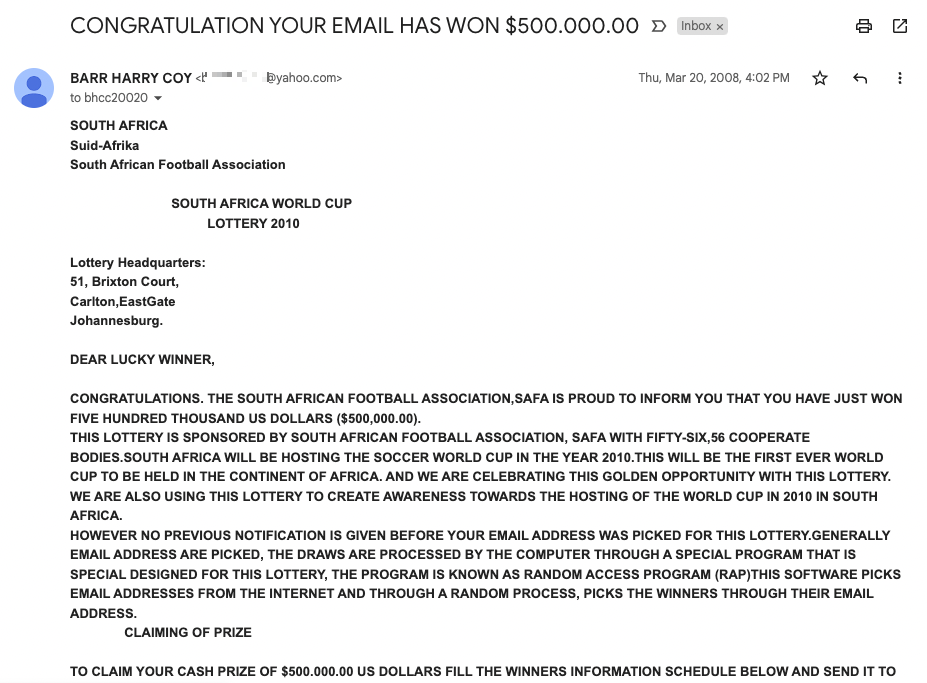

10. Lottery scams

In this strategy, scammers contact consumers by phone or email and tell them they’ve won the lottery. The prize doesn’t exist, but the criminals will get you to pay fake registration fees or taxes, or they’ll steal your information.

These are a few red flags you can look out for to spot a lottery scam:

- You’re told you’ve won a lottery in a foreign country.

- You don’t remember buying any lottery tickets.

- You’re asked for financial details.

- You’re told you need to pay a fee to get your winnings. No lottery will ever do this.

11. Debt relief and credit repair scams

In this scam, fraudsters promise to negotiate with your creditors about lower repayment plans or eliminating debts, but they ask for a fee to start the process.

The success of this scam depends on targeting consumers desperate to rebuild their credit after a financial setback. The goal is to get you to pay a fee or provide financial information.

Here are some tips on how to identify these scams:

- You get offered a rate that seems unrealistically good.

- The email makes it all sound easy, as if your debts will just disappear.

- You’re asked for a fee upfront.

12. Money transfer/check scams

Check and transfer scams persuade victims to transfer funds or deposit a check. Sometimes they offer you money in return for your bank info. These scammers may take money from your account without permission or charge you to send rewards.

This is how you can spot them:

- You’re asked to transfer money for a stranger.

- You've been asked to send funds overseas through a wire transfer.

How to avoid online scams

Recognizing all these different types of internet scams is just the start. What else can you do to protect yourself?

Here are a few general rules to help you avoid online scams:

- Always update your devices. This will make sure you have all security updates you’re supposed to have, helping you avoid malware.

- Create strong passwords with numbers, symbols, uppercase, and lowercase letters. Also, make sure they’re unique and not reused on other sites.

- Never share your personal information or account details. Even if you trust the other party, you have no way to guarantee they take security seriously.

- Protect your internet and wi-fi with a VPN. This will encrypt your web traffic, so it’s unreadable to outsiders.

- Ignore suspicious calls and emails. If you do answer, don’t hand over any personal data or click on any attachments.

- Google any phone numbers, email address, or website URLs you’re unsure about.

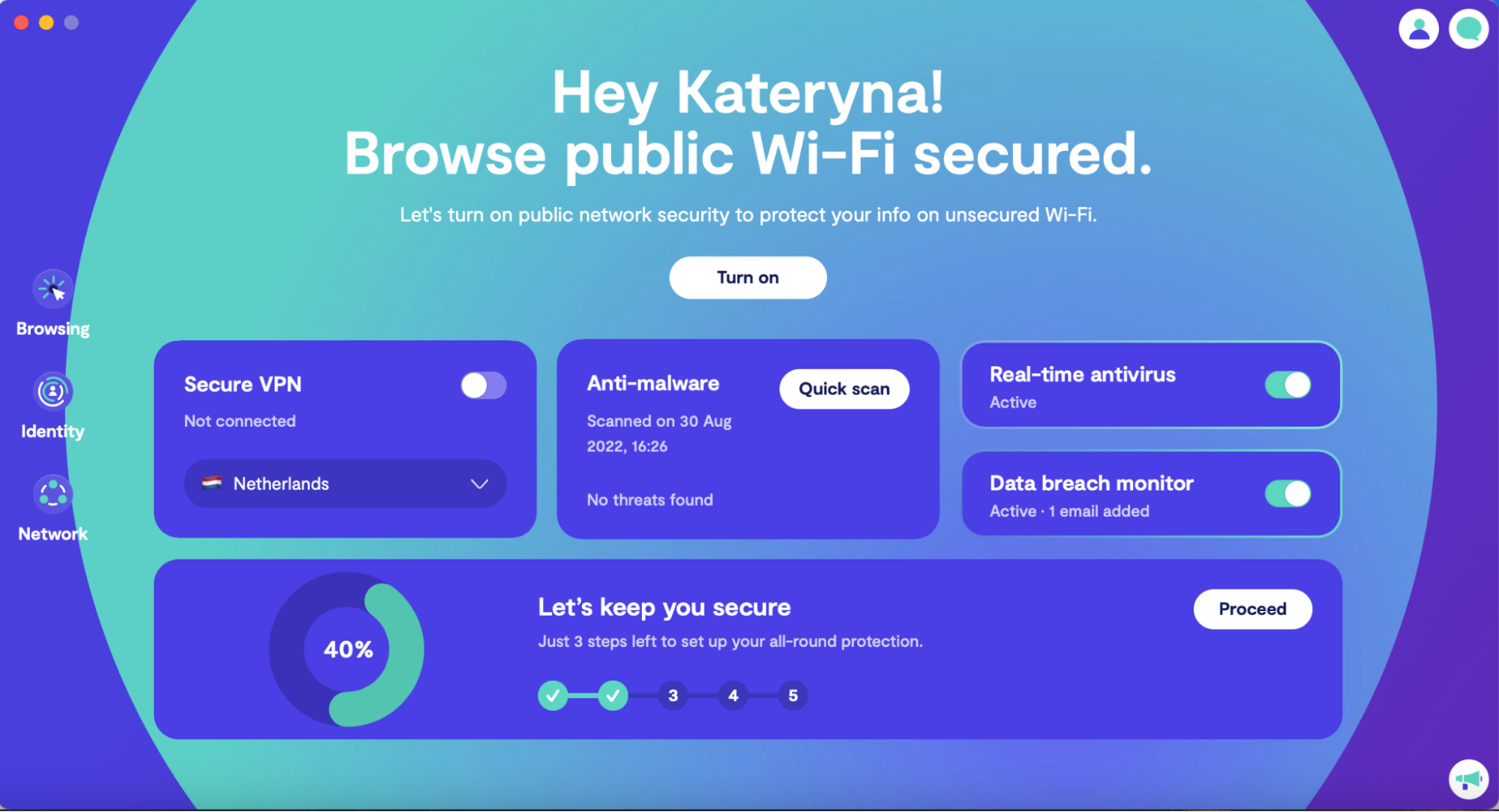

- Install a security solution, such as Clario, to protect yourself from malware and identify theft.

What to do if you fall victim to an online scam

If you’re careful about what you click on, the websites you visit and the emails you open, you can avoid falling victim to most online scams. But if it does happen or you think it might have, here’s what you should do.

- Immediately contact your bank if you think your account has been affected. They can look out for suspicious activity on your account and cancel your cards if necessary.

- Change any passwords you think might have been compromised. If you’ve used those passwords anywhere else, change them in those other places too.

- If you think scammers are using your contacts list, tell people to be on the lookout for suspicious messages that seem come from you.

- Run a full virus scan with Clario to make sure there’s no malware on your devices.

Here’s how to run a scan with Clario:

- Launch the Clario app and set up an account.

- Click Quick scan next to Anti-malware.

3. Wait for Clario to finish looking for malware on your computer.

If a malicious file is found, follow Clario’s instructions on how to remove it.